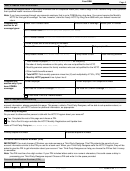

Your SSN

Department of the Treasury - Internal Revenue Service

13441-A

Health Coverage Tax Credit (HCTC)

OMB Number

Form

1545-1842

(May 2017)

Monthly Registration and Update

Part 1: Your General Information

HCTC Eligible Recipient name

(First, Middle Initial, Last, Suffix)

Social Security Number (SSN)

Date of birth

Primary telephone number

Alternate telephone number

(mm/dd/yyyy)

Mailing Address

(Street Number, City, State, ZIP)

Part 2: Confirm Your Eligibility

Check the box that applies to you to certify that the statement is true:

I am a PBGC payee and 55 years old or older.

I am an eligible Trade Adjustment Assistance (TAA), Alternative TAA (ATAA), or Reemployment TAA (RTAA) recipient.

Check the box to certify that you meet all general requirements listed below.

I certify that all of the following statements are true for me and my qualified family members.

• I/we are not enrolled in an Affordable Care Act Marketplace insurance.

• I/we are covered by a qualified health plan for which I pay more than 50% of the premiums.

• I/we are not enrolled in Medicare Part A, B, C, or D.

• I/we are not enrolled in Medicaid or the Children’s Health Insurance Program (CHIP).

• I/we are not enrolled in the Federal Employees Health Benefits Program (FEHBP).

• I/we are not enrolled in the U.S. military health system (TRICARE).

• I/we are not imprisoned under federal, state, or local authority.

• I/we are not claimed as a dependent on someone else’s federal income tax return.

Part 3: Family Member Information

If you have more than three (3) qualified family members, make a copy of this page and then complete this section for any additional

family members.

Please list the total number of family members

you are registering for the Monthly HCTC.

(other than yourself)

Check the box to certify that the following applies to each family member listed below:

• My family member is my spouse or claimed as a dependent on my federal income tax return and

• My family member meets all general requirements for the HCTC listed in Part 2

.

(with the exception of the last bullet)

1

Family member’s name

Social security number (SSN)

Date of birth

(First, Middle Initial, Last, Suffix)

(mm/dd/yyyy)

Relationship to you

Is this person on your health plan?

Spouse

Child

Other

Yes

No. This person has a separate qualified plan. Make a copy of the next page

and use Part 4 to provide their health insurance information.

2

Family member’s name

Social security number (SSN)

Date of birth

(First, Middle Initial, Last, Suffix)

(mm/dd/yyyy)

Relationship to you

Is this person on your health plan?

Spouse

Child

Other

Yes

No. This person has a separate qualified plan. Make a copy of the next page

and use Part 4 to provide their health insurance information.

3

Family member’s name

Social security number (SSN)

Date of birth

(First, Middle Initial, Last, Suffix)

(mm/dd/yyyy)

Relationship to you

Is this person on your health plan?

Spouse

Child

Other

Yes

No. This person has a separate qualified plan. Make a copy of the next page

and use Part 4 to provide their health insurance information.

13441-A

Catalog Number 57559E

Form

(Rev. 5-2017)

1

1 2

2 3

3 4

4