Your SSN

Page 3

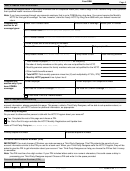

Part 4: Health Plan Information

Fill out the information below. If your family members are on a separate health plan, make a copy of Part 4 before filling it out to provide

their qualified health insurance information.

Note: If you have coverage through your spouse’s employer that is not a COBRA plan, stop here. You cannot receive the Monthly

HCTC for this type of coverage. You can, however, claim the Yearly HCTC by filing Form 8885 with your federal income tax

return.

Health Plan Provider name

Effective date of coverage

Health plan ID number

Complete this

section for all

coverage types:

HCTC vendor name

(name of company to be payed on your behalf)

HCTC vendor number

(contact your Health Plan Provider or Third Party Administrator)

Provide at least one of the following ID Numbers.

Member ID

Group ID

Policy or plan ID

Policy holder’s name

Policy holder’s SSN

Total monthly premium

(First, Middle Initial, Last, Suffix)

1. Total number of people

on this policy

(you and any family members)

2. Number of family members on this policy who are not qualified for the HCTC

3. Monthly premium amount for family members who are not qualified for the HCTC

4. Other health benefits amount

5. Total HCTC Total monthly premium minus line (3) and multiplied by 27.5% (.275)

6. Monthly HCTC payment Line 4 plus Line 5

Former employer

Former employer’s HR telephone number

Complete this

section only if you

have COBRA

Start Date for COBRA Coverage

End Date for COBRA Coverage

coverage:

(mm/dd/yyyy)

(mm/dd/yyyy)

Check here if this is a Lifetime Benefit.

Part 5: Account Accessibility

If you would like to allow someone else – for example, your spouse, family member, or other trusted advisor – to have access to your

account information, please complete this page. This person, called a Third-Party-Designee, will be able to ask questions about, or

make changes to, your HCTC account or personal information, as appropriate.

Third-Party-Designee

Do you want to allow another person to talk with the HCTC Program about your account?

Yes. Complete the rest of this page and choose a PIN.

No. Go to Part 6 to sign and date the HCTC Monthly Registration and Update form.

Name of Third-Party-Designee

(First, Middle Initial, Last, Suffix)

Primary telephone number

Alternate telephone number

Personal Identification Number (PIN)

IMPORTANT! You must choose a PIN when you make someone a Third-Party-Designee. This PIN protects the security of your

account information similar to the PIN you use for a bank card. When your Third-Party-Designee calls the HCTC Program, they will be

asked to give the PIN to get information about your account. Your Third-Party-Designee can help you choose the PIN so that it is easy

to remember.

Note: The PIN must be a five-digit number. If your PIN includes letters and/or non-numeric characters, this could cause a delay in

processing your Third-Party-Designee request. Choose a PIN and write it in the space provided.

Personal Identification Number (PIN)

13441-A

Catalog Number 57559E

Form

(Rev. 5-2017)

1

1 2

2 3

3 4

4