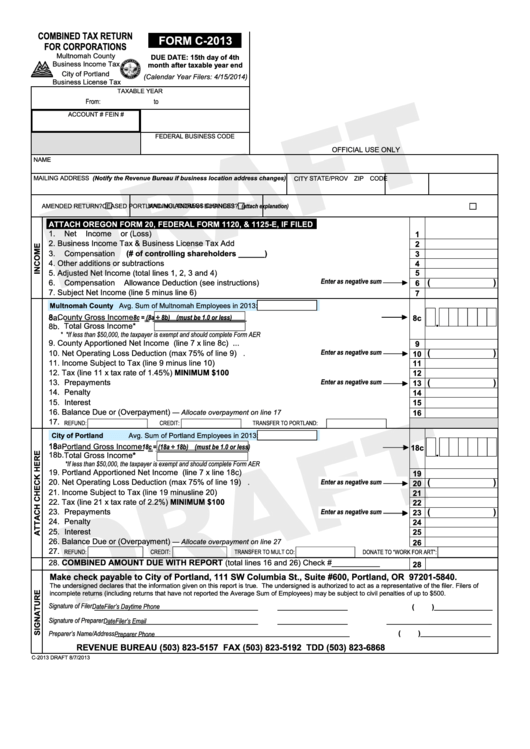

Form C-2013 Draft - Combined Tax Return For Corporations - 2013

ADVERTISEMENT

COMBINED TAX RETURN

FORM C-2013

FOR CORPORATIONS

Multnomah County

DUE DATE: 15th day of 4th

Business Income Tax

month after taxable year end

City of Portland

(Calendar Year Filers: 4/15/2014)

Business License Tax

TAXABLE YEAR

From:

to

ACCOUNT #

FEIN #

FEDERAL BUSINESS CODE

OFFICIAL USE ONLY

NAME

MAILING ADDRESS (Notify the Revenue Bureau if business location address changes)

CITY

STATE/PROV ZIP CODE

AMENDED RETURN?

MAILING ADDRESS CHANGE?

CEASED PORTLAND/MULTNOMAH BUSINESS? (attach explanation)

ATTACH OREGON FORM 20, FEDERAL FORM 1120, & 1125-E, IF FILED

1.

Net Income or (Loss) ..........................................................................................................................

1

2.

Business Income Tax & Business License Tax Add Back...................................................................

2

3.

Compensation (# of controlling shareholders ______) ..................................................................

3

4.

Other additions or subtractions ..........................................................................................................

4

5.

Adjusted Net Income (total lines 1, 2, 3 and 4)....................................................................................

5

(

)

6.

Compensation Allowance Deduction (see instructions) .....................................................................

Enter as negative sum

6

7.

Subject Net Income (line 5 minus line 6) ............................................................................................

7

Multnomah County Avg. Sum of Multnomah Employees in 2013:

8a.

8.

County Gross Income

.........

8c = (8a ÷ 8b)

(must be 1.0 or less)

8c

.

=

8b.

Total Gross Income*

* *If less than $50,000, the taxpayer is exempt and should complete Form AER

9.

County Apportioned Net Income (line 7 x line 8c) .............................................................................

9

(

)

10. Net Operating Loss Deduction (max 75% of line 9) ...........................................................................

Enter as negative sum

10

11. Income Subject to Tax (line 9 minus line 10) ......................................................................................

11

12. Tax (line 11 x tax rate of 1.45%) MINIMUM $100 ..............................................................................

12

(

)

13. Prepayments ......................................................................................................................................

Enter as negative sum

13

14. Penalty ...............................................................................................................................................

14

15. Interest ...............................................................................................................................................

15

16. Balance Due or (Overpayment)

........................................................

— Allocate overpayment on line 17

16

17.

REFUND:

CREDIT:

TRANSFER TO PORTLAND:

City of Portland

Avg. Sum of Portland Employees in 2013:

18a.

18. Portland Gross Income

.........

18c = (18a ÷ 18b) (must be 1.0 or less)

18c

=

.

18b.

Total Gross Income*

*If less than $50,000, the taxpayer is exempt and should complete Form AER

19. Portland Apportioned Net Income (line 7 x line 18c) ..........................................................................

19

(

)

20. Net Operating Loss Deduction (max 75% of line 19) ..........................................................................

Enter as negative sum

20

21. Income Subject to Tax (line 19 minus line 20) .....................................................................................

21

22. Tax (line 21 x tax rate of 2.2%) MINIMUM $100 .................................................................................

22

(

)

23. Prepayments .......................................................................................................................................

23

Enter as negative sum

24. Penalty ................................................................................................................................................

24

25. Interest ................................................................................................................................................

25

26. Balance Due or (Overpayment)

.........................................................

— Allocate overpayment on line 27

26

27.

REFUND:

CREDIT:

TRANSFER TO MULT CO:

DONATE TO “WORK FOR ART”:

COMBINED AMOUNT DUE WITH REPORT

28.

(total lines 16 and 26) Check #___________ ..........

28

Make check payable to City of Portland, 111 SW Columbia St., Suite #600, Portland, OR 97201-5840.

The undersigned declares that the information given on this report is true. The undersigned is authorized to act as a representative of the filer. Filers of

incomplete returns (including returns that have not reported the Average Sum of Employees) may be subject to civil penalties of up to $500.

Signature of Filer

__________________________________________

__________________

(

)_______________

Date

Filer’s Daytime Phone

_______________________________________

__________________

___________________________

Signature of Preparer

Date

Filer’s Email

Preparer’s Name/Address

____________________________________________________________

(

)__________________

Preparer Phone

REVENUE BUREAU (503) 823-5157

FAX (503) 823-5192

TDD (503) 823-6868

C-2013 DRAFT 8/7/2013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2