Form Nc-478g - Tax Credit Investing In Renewable Energy Property - 2000

ADVERTISEMENT

File with NC-478

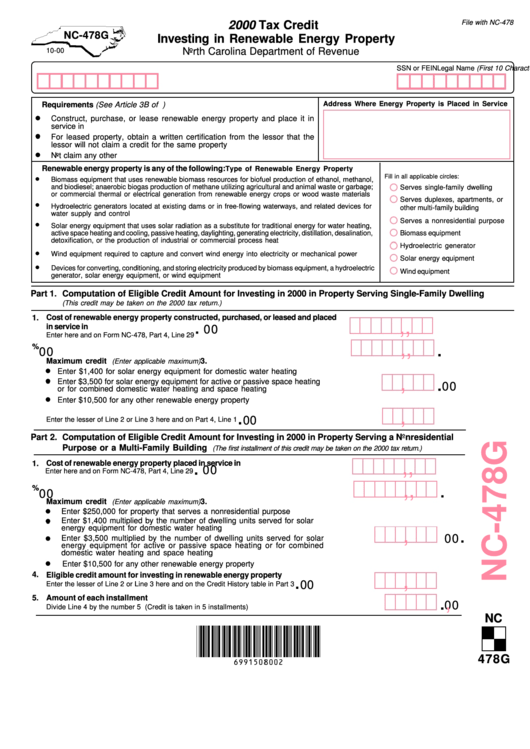

2000 Tax Credit

NC-478G

Investing in Renewable Energy Property

North Carolina Department of Revenue

10-00

Legal Name (First 10 Characters)

SSN or FEIN

Address Where Energy Property is Placed in Service

Requirements (See Article 3B of G.S. Chapter 105 for more information.)

Construct, purchase, or lease renewable energy property and place it in

service in N.C. during the tax year

For leased property, obtain a written certification from the lessor that the

lessor will not claim a credit for the same property

Not claim any other N.C. tax credit for the same renewable energy property

Renewable energy property is any of the following:

Type of Renewable Energy Property

Fill in all applicable circles:

Biomass equipment that uses renewable biomass resources for biofuel production of ethanol, methanol,

and biodiesel; anaerobic biogas production of methane utilizing agricultural and animal waste or garbage;

Serves single-family dwelling

or commercial thermal or electrical generation from renewable energy crops or wood waste materials

Serves duplexes, apartments, or

Hydroelectric generators located at existing dams or in free-flowing waterways, and related devices for

other multi-family building

water supply and control

Serves a nonresidential purpose

Solar energy equipment that uses solar radiation as a substitute for traditional energy for water heating,

active space heating and cooling, passive heating, daylighting, generating electricity, distillation, desalination,

Biomass equipment

detoxification, or the production of industrial or commercial process heat

Hydroelectric generator

Wind equipment required to capture and convert wind energy into electricity or mechanical power

Solar energy equipment

Devices for converting, conditioning, and storing electricity produced by biomass equipment, a hydroelectric

Wind equipment

generator, solar energy equipment, or wind equipment

Part 1.

Computation of Eligible Credit Amount for Investing in 2000 in Property Serving Single-Family Dwelling

(This credit may be taken on the 2000 tax return.)

1.

Cost of renewable energy property constructed, purchased, or leased and placed

,

,

.

in service in N.C. in 2000 for one single-family dwelling

00

Enter here and on Form NC-478, Part 4, Line 29

,

,

.

2.

Multiply Line 1 by 35.0%

00

3.

Maximum credit

(Enter applicable maximum)

Enter $1,400 for solar energy equipment for domestic water heating

,

.

Enter $3,500 for solar energy equipment for active or passive space heating

00

or for combined domestic water heating and space heating

Enter $10,500 for any other renewable energy property

4. Eligible credit amount for investing in single-family renewable energy property

,

.

00

Enter the lesser of Line 2 or Line 3 here and on Part 4, Line 1

Part 2.

Computation of Eligible Credit Amount for Investing in 2000 in Property Serving a Nonresidential

Purpose or a Multi-Family Building

(The first installment of this credit may be taken on the 2000 tax return.)

Cost of renewable energy property placed in service in N.C. in 2000

,

,

.

1.

00

Enter here and on Form NC-478, Part 4, Line 29

,

,

.

2. Multiply Line 1 by 35.0%

00

3.

Maximum credit

(Enter applicable maximum)

Enter $250,000 for property that serves a nonresidential purpose

Enter $1,400 multiplied by the number of dwelling units served for solar

energy equipment for domestic water heating

,

.

00

Enter $3,500 multiplied by the number of dwelling units served for solar

energy equipment for active or passive space heating or for combined

domestic water heating and space heating

Enter $10,500 for any other renewable energy property

4. Eligible credit amount for investing in renewable energy property

,

.

00

Enter the lesser of Line 2 or Line 3 here and on the Credit History table in Part 3

5.

Amount of each installment

,

.

00

Divide Line 4 by the number 5 (Credit is taken in 5 installments)

NC

478G

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2