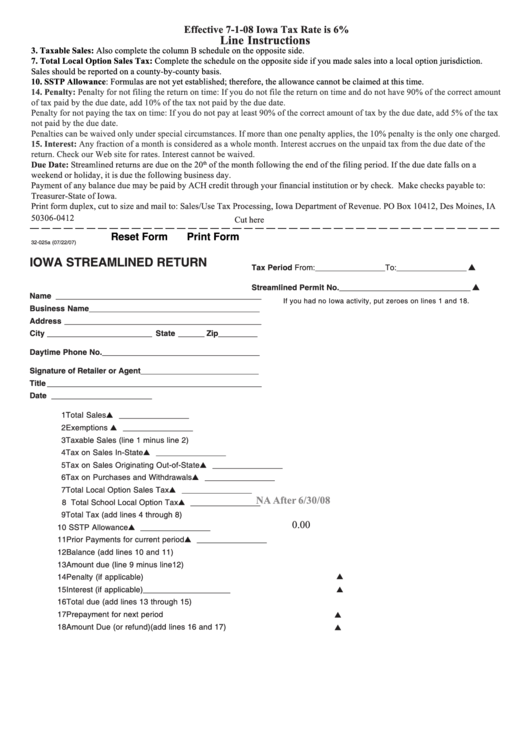

Effective 7-1-08 Iowa Tax Rate is 6%

Line Instructions

3. Taxable Sales: Also complete the column B schedule on the opposite side.

7. Total Local Option Sales Tax: Complete the schedule on the opposite side if you made sales into a local option jurisdiction.

Sales should be reported on a county-by-county basis.

10. SSTP Allowance: Formulas are not yet established; therefore, the allowance cannot be claimed at this time.

14. Penalty: Penalty for not filing the return on time: If you do not file the return on time and do not have 90% of the correct amount

of tax paid by the due date, add 10% of the tax not paid by the due date.

Penalty for not paying the tax on time: If you do not pay at least 90% of the correct amount of tax by the due date, add 5% of the tax

not paid by the due date.

Penalties can be waived only under special circumstances. If more than one penalty applies, the 10% penalty is the only one charged.

15. Interest: Any fraction of a month is considered as a whole month. Interest accrues on the unpaid tax from the due date of the

return. Check our Web site for rates. Interest cannot be waived.

Due Date: Streamlined returns are due on the 20

of the month following the end of the filing period. If the due date falls on a

th

weekend or holiday, it is due the following business day.

Payment of any balance due may be paid by ACH credit through your financial institution or by check. Make checks payable to:

Treasurer-State of Iowa.

Print form duplex, cut to size and mail to: Sales/Use Tax Processing, Iowa Department of Revenue. PO Box 10412, Des Moines, IA

50306-0412

Cut here

Reset Form

Print Form

32-025a (07/22/07)

IOWA STREAMLINED RETURN

Tax Period From: ________________ To: ________________

Streamlined Permit No. ______________________________

Name _______________________________________________

If you had no Iowa activity, put zeroes on lines 1 and 18.

Business Name _______________________________________

Address _____________________________________________

City ________________________ State ______ Zip _________

Daytime Phone No. ____________________________________

Signature of Retailer or Agent ___________________________

Title _________________________________________________

Date _______________________

1 Total Sales ..................................................... 1

________________

2 Exemptions .................................................... 2

________________

3 Taxable Sales (line 1 minus line 2) ............... 3

________________

4 Tax on Sales In-State .................................... 4

________________

5 Tax on Sales Originating Out-of-State .......... 5

________________

6 Tax on Purchases and Withdrawals ............. 6

________________

7 Total Local Option Sales Tax ........................ 7

________________

NA After 6/30/08

8 Total School Local Option Tax ...................... 8

________________

9 Total Tax (add lines 4 through 8) .............................................................. 9

___________________

0.00

10 SSTP Allowance ............................................. 10

________________

11 Prior Payments for current period ................. 11

________________

12 Balance (add lines 10 and 11) .................................................................. 12

____________________

13 Amount due (line 9 minus line12) ............................................................. 13

____________________

14 Penalty (if applicable) ................................................................................ 14

____________________

15 Interest (if applicable) ................................................................................ 15

____________________

16 Total due (add lines 13 through 15) .......................................................... 16

____________________

17 Prepayment for next period ....................................................................... 17

____________________

18 Amount Due (or refund)(add lines 16 and 17) .......................................... 18

____________________

1

1 2

2