ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI

001

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI

ABCDEFGHI ABCDEFGHI

012345678

X

X

X

X

X

X

X

-123456789012345

-123456789012345

123.12

-123456789012345

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDE

YYYY-MM-DD

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDE

1234567

123456789 ABCDEFGHI ABCDEFGHI ABCDE

123456789 ABCDEFGHI ABCDEFGHI ABCDE

UK

1234567890

X

-123456789012345

-123456789012345

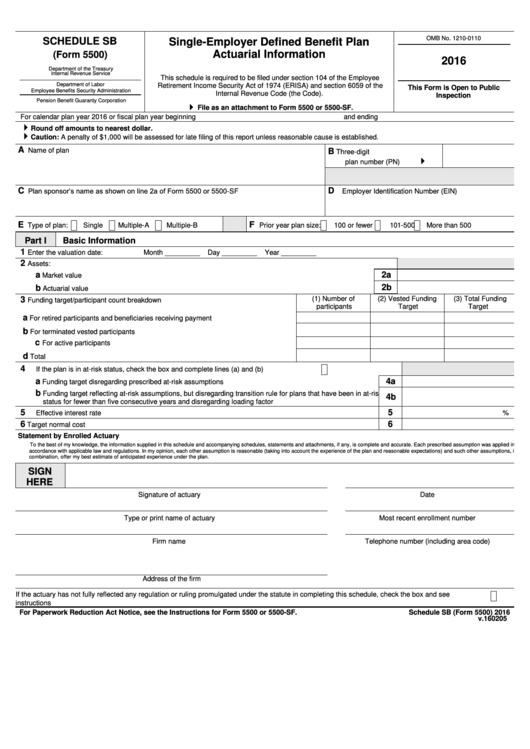

OMB No. 1210-0110

SCHEDULE SB

Single-Employer Defined Benefit Plan

Actuarial Information

(Form 5500)

2016

Department of the Treasury

Internal Revenue Service

This schedule is required to be filed under section 104 of the Employee

Department of Labor

Retirement Income Security Act of 1974 (ERISA) and section 6059 of the

This Form is Open to Public

Employee Benefits Security Administration

Internal Revenue Code (the Code).

Inspection

Pension Benefit Guaranty Corporation

File as an attachment to Form 5500 or 5500-SF.

For calendar plan year 2016 or fiscal plan year beginning

and ending

Round off amounts to nearest dollar.

Caution: A penalty of $1,000 will be assessed for late filing of this report unless reasonable cause is established.

A

Name of plan

B

Three-digit

plan number (PN)

Plan sponsor’s name as shown on line 2a of Form 5500 or 5500-SF

C

D

Employer Identification Number (EIN)

E

F

Type of plan:

Single

Multiple-A

Multiple-B

Prior year plan size:

100 or fewer

101-500

More than 500

Part I

Basic Information

1

Enter the valuation date:

Month _________

Day _________

Year _________

2

Assets:

a

2a

Market value .....................................................................................................................................................

2b

b

Actuarial value ..................................................................................................................................................

3

(1) Number of

(2) Vested Funding

(3) Total Funding

Funding target/participant count breakdown

participants

Target

Target

a

For retired participants and beneficiaries receiving payment ..................................... .

b

For terminated vested participants.............................................................................

c

For active participants ................................................................................................

d

Total ..........................................................................................................................

4

If the plan is in at-risk status, check the box and complete lines (a) and (b).............................

a

4a

Funding target disregarding prescribed at-risk assumptions ...............................................................................

b

Funding target reflecting at-risk assumptions, but disregarding transition rule for plans that have been in at-risk

4b

status for fewer than five consecutive years and disregarding loading factor ......................................................

5

5

Effective interest rate .............................................................................................................................................

%

6

6

Target normal cost .................................................................................................................................................

Statement by Enrolled Actuary

To the best of my knowledge, the information supplied in this schedule and accompanying schedules, statements and attachments, if any, is complete and accurate. Each prescribed assumption was applied in

accordance with applicable law and regulations. In my opinion, each other assumption is reasonable (taking into account the experience of the plan and reasonable expectations) and such other assumptions, in

combination, offer my best estimate of anticipated experience under the plan.

SIGN

HERE

Signature of actuary

Date

Type or print name of actuary

Most recent enrollment number

Firm name

Telephone number (including area code)

Address of the firm

If the actuary has not fully reflected any regulation or ruling promulgated under the statute in completing this schedule, check the box and see

instructions

For Paperwork Reduction Act Notice, see the Instructions for Form 5500 or 5500-SF.

Schedule SB (Form 5500) 2016

v. 160205

1

1 2

2 3

3