Reset Form

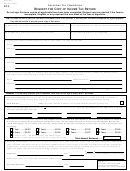

Michigan Department of Treasury

2078 (Rev. 02-14)

Request for Disclosure of Michigan Tax Return Information

(State and Local Government Units)

Issued under authority of Public Act 122 of 1941, as amended.

PART 1: REQUESTING AGENCY INFORMATION

Name of Government Unit Requesting Information

Telephone Number

Address (Number and Street)

City

State

ZIP Code

We are requesting information per MCL 205.28 (1)(f) and an agreement between the agency named above and the Michigan Department of Treasury.

Please provide the information on the individual or business named below.

PART 2: INDIVIDUAL TAXPAYER

Taxpayer Last Name

First Name

MI

Social Security Number

Secondary Taxpayer Last Name

First Name

MI

Social Security Number

Address (Street)

City

State

ZIP Code

PART 3: BUSINESS TAXPAYER

Business or Corporation Name

Federal Employer ID No. (FEIN) or Michigan ID No.

Address (Street)

City

State

ZIP Code

Names of Owners or Partners

Type of tax return information needed:

Income Tax

SBT

MBT

CIT

SUW

Other

For tax years:

Specify other information needed:

Reason for request

Check this box if the information must be certified by the Disclosure Officer and is expected to be presented in court.

I declare that I am authorized to request and receive the above information under the exchange agreement between the Michigan Department of Treasury and

the agency named above (Government Unit).

I declare that I have signed the Confidentiality Agreement and understand that any Michigan Department of Treasury tax returns or tax return information made

available to me will not be divulged or made known in any manner to any person except as may be necessary in the performance of my official duties. Access to

Treasury information is allowed on a need-to-know basis to perform my official duties. I further understand that under the Michigan Revenue Act, MCL205.28(1)

(f} I may not willfully browse any return or information contained in a return. Browsing is defined as examining a return or return information acquired by a person

or another person without authorization or without a need to know the information to perform official duties. I understand the penalties that apply if I disclose

information obtained to perform my job duties.

This form and any attached return information must be returned to your department liaison in charge of tracking, receiving, and destroying Michigan tax return

information.

Signature

Date

Signature of Agency Head/Designee

Date

Print Name of Employee Initiating Request

Print Name of Agency Head/Designee

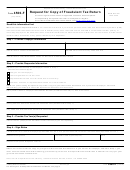

PART 4: FEE SCHEDULE

Local units of goverment or other third parties must pay the fee described here. Taxpayers may receive copies of their personal tax refunds at no charge. Payment

for tax return information must accompany the request. Make checks payable to the State of Michigan and write index code #19180 on the check.

First Year

$ 5.00

$ 5.00

Additional Year(s)

$ 3.00 X

FEE TOTAL

TREASURY USE ONLY

1. The attached information is furnished for tax year(s) __________________________________________________________________________________.

2. No record of filing a return/credit for tax year(s) ______________________________________________________________________________________.

3. The account number provided is being used by another taxpayer.

4. We are unable to locate a business tax record under the name(s) provided.

5. Other _______________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________.

Disclosure Office Approval

Date

Allow 60 days to process

your request.

Send this form to: Michigan Department of Treasury, Office of Privacy and Security, Disclosure Unit, 430 W. Allegan Street, Lansing, MI 48922.

Telephone Number: (517) 636-4239

1

1