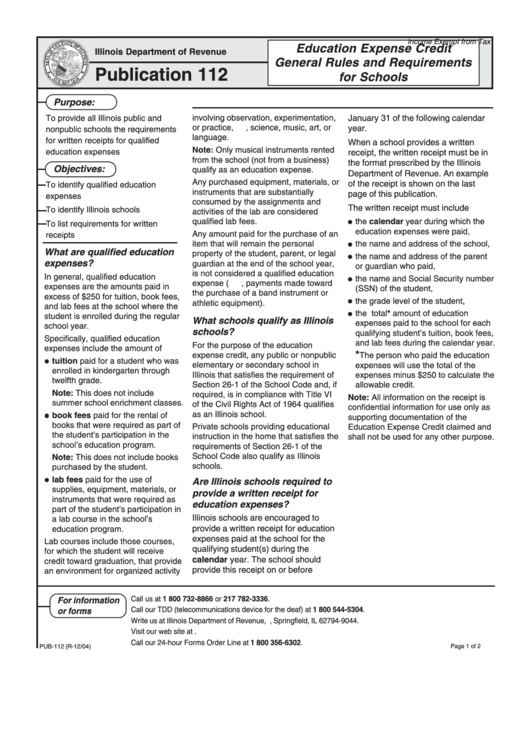

Publication 112 - Education Expense Credit General Rules And Requirements For Schools - Illinois Department Of Revenue

ADVERTISEMENT

Income Exempt from Tax

Education Expense Credit

Illinois Department of Revenue

General Rules and Requirements

Publication 112

for Schools

Purpose:

involving observation, experimentation,

To provide all Illinois public and

January 31 of the following calendar

or practice, i.e. , science, music, art, or

year.

nonpublic schools the requirements

language.

for written receipts for qualified

When a school provides a written

Note: Only musical instruments rented

education expenses

receipt, the written receipt must be in

from the school (not from a business)

the format prescribed by the Illinois

Objectives:

qualify as an education expense.

Department of Revenue. An example

Any purchased equipment, materials, or

of the receipt is shown on the last

To identify qualified education

instruments that are substantially

page of this publication.

expenses

consumed by the assignments and

The written receipt must include

To identify Illinois schools

activities of the lab are considered

qualified lab fees.

the calendar year during which the

To list requirements for written

education expenses were paid,

Any amount paid for the purchase of an

receipts

item that will remain the personal

the name and address of the school,

What are qualified education

property of the student, parent, or legal

the name and address of the parent

expenses?

guardian at the end of the school year,

or guardian who paid,

is not considered a qualified education

In general, qualified education

the name and Social Security number

expense ( e.g. , payments made toward

expenses are the amounts paid in

(SSN) of the student,

the purchase of a band instrument or

excess of $250 for tuition, book fees,

the grade level of the student,

athletic equipment).

and lab fees at the school where the

the total* amount of education

student is enrolled during the regular

What schools qualify as Illinois

expenses paid to the school for each

school year.

schools?

qualifying student’s tuition, book fees,

Specifically, qualified education

and lab fees during the calendar year.

For the purpose of the education

expenses include the amount of

*

expense credit, any public or nonpublic

The person who paid the education

tuition paid for a student who was

elementary or secondary school in

expenses will use the total of the

enrolled in kindergarten through

Illinois that satisfies the requirement of

expenses minus $250 to calculate the

twelfth grade.

Section 26-1 of the School Code and, if

allowable credit.

Note: This does not include

required, is in compliance with Title VI

Note: All information on the receipt is

summer school enrichment classes.

of the Civil Rights Act of 1964 qualifies

confidential information for use only as

as an Illinois school.

book fees paid for the rental of

supporting documentation of the

books that were required as part of

Private schools providing educational

Education Expense Credit claimed and

the student’s participation in the

instruction in the home that satisfies the

shall not be used for any other purpose.

school’s education program.

requirements of Section 26-1 of the

School Code also qualify as Illinois

Note: This does not include books

schools.

purchased by the student.

lab fees paid for the use of

Are Illinois schools required to

supplies, equipment, materials, or

provide a written receipt for

instruments that were required as

education expenses?

part of the student’s participation in

Illinois schools are encouraged to

a lab course in the school’s

provide a written receipt for education

education program.

expenses paid at the school for the

Lab courses include those courses,

qualifying student(s) during the

for which the student will receive

calendar year. The school should

credit toward graduation, that provide

provide this receipt on or before

an environment for organized activity

Call us at 1 800 732-8866 or 217 782-3336.

For information

Call our TDD (telecommunications device for the deaf) at 1 800 544-5304.

or forms

Write us at Illinois Department of Revenue, P.O. Box 19044, Springfield, IL 62794-9044.

Visit our web site at

Call our 24-hour Forms Order Line at 1 800 356-6302.

PUB-112 (R-12/04)

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2