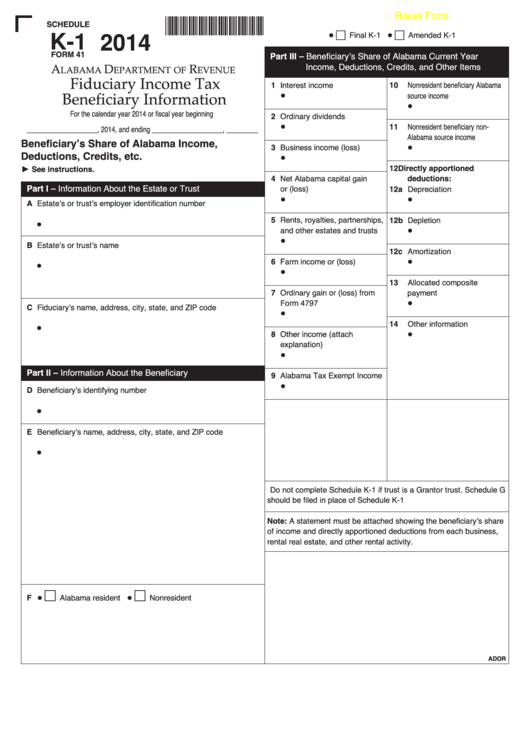

Reset Form

14000541

Final K-1 •

Amended K-1

SCHEDULE

K 1

2014

•

Part III – Beneficiary’s Share of Alabama Current Year

Income, Deductions, Credits, and Other Items

FORM 41

A

D

r

lAbAmA

epArtment of

evenue

1 Interest income

Nonresident beneficiary Alabama

fiduciary Income tax

10

source income

•

beneficiary Information

For the calendar year 2014 or fiscal year beginning

2 Ordinary dividends

•

Nonresident beneficiary non-

____________________, 2014, and ending ____________________, _________

•

11

Alabama source income

3 Business income (loss)

Beneficiary’s Share of Alabama Income,

•

Deductions, Credits, etc.

•

4 Net Alabama capital gain

12

Directly apportioned

See instructions.

Part I – Information About the Estate or Trust

or (loss)

12a Depreciation

deductions:

A Estate’s or trust’s employer identification number

•

•

5 Rents, royalties, partnerships,

12b Depletion

and other estates and trusts

•

•

B Estate’s or trust’s name

•

12c Amortization

6 Farm income or (loss)

•

•

•

Allocated composite

7 Ordinary gain or (loss) from

payment

13

Form 4797

C Fiduciary’s name, address, city, state, and ZIP code

•

Other information

•

8 Other income (attach

14

•

explanation)

•

•

Part II – Information About the Beneficiary

9 Alabama Tax Exempt Income

D Beneficiary’s identifying number

•

•

E Beneficiary’s name, address, city, state, and ZIP code

•

Do not complete Schedule K-1 if trust is a Grantor trust. Schedule G

should be filed in place of Schedule K-1

Note: A statement must be attached showing the beneficiary’s share

of income and directly apportioned deductions from each business,

rental real estate, and other rental activity.

Alabama resident •

Nonresident

F •

ADOR

1

1 2

2