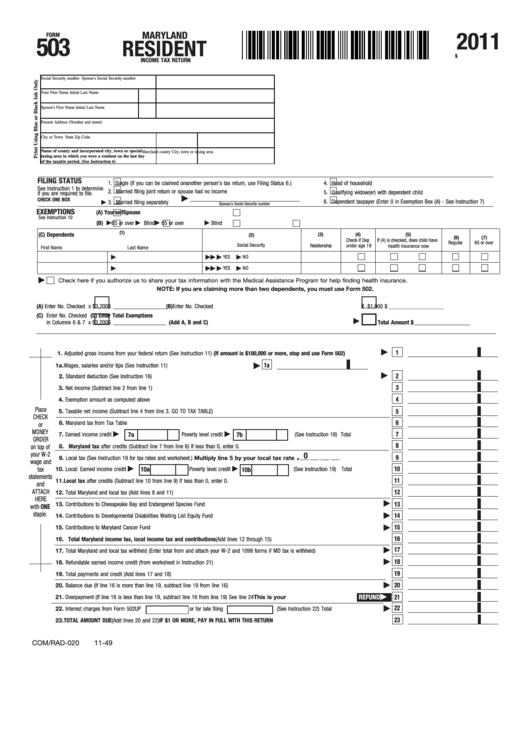

2011

MARYLAND

FORM

503

RESIDENT

$

INCOME TAX RETURN

115030049

Social Security number

Spouse's Social Security number

Your First Name

Initial

Last Name

Spouse's First Name

Initial

Last Name

Present Address (Number and street)

City or Town

State

Zip Code

Maryland county

City, town or taxing area

Name of county and incorporated city, town or special

taxing area in which you were a resident on the last day

of the taxable period. (See Instruction 6)

FILINg STATUS

1.

Single (If you can be claimed on another person’s tax return, use Filing Status 6.)

4.

head of household

See Instruction 1 to determine

2.

Married filing joint return or spouse had no income

5.

Qualifying widow(er) with dependent child

if you are required to file.

CHECK ONE BOX

6.

Dependent taxpayer (Enter 0 in Exemption Box (A) - See Instruction 7)

3.

Married filing separately

Spouse's Social Security number

EXEMPTIONS

(A)

Yourself

Spouse

See Instruction 10

(B)

65 or over

Blind

65 or over

Blind

(1)

(C) Dependents

(3)

(4)

(5)

(2)

(6)

(7)

Check if Dep

If (4) is checked, does child have

Regular

65 or over

Social Security

Relationship

under age 19

health insurance now

First Name

Last Name

yES

NO

yES

NO

Check here if you authorize us to share your tax information with the Medical Assistance Program for help finding health insurance.

NOTE: If you are claiming more than two dependents, you must use Form 502.

(A) Enter No. Checked

x $3,200 . . . . . . . $ __________________

(B)

Enter No. Checked . . . . . . . . . . . . .

X $1,000

$ ___________________

(C) Enter No. Checked

(D)

Enter Total Exemptions

in Columns 6 & 7

x $3,200 . . . . . . . $ __________________

(Add A, B and C) . . . . . . . . . . . . . .

Total Amount

$ ___________________

1

1. Adjusted gross income from your federal return (See Instruction 11) (If amount is $100,000 or more, stop and use Form 502) ....................

1a. Wages, salaries and/or tips (See Instruction 11) .......................................................

1a

2

2. Standard deduction (See Instruction 16) ...............................................................................................................................................................

3

3. Net income (Subtract line 2 from line 1) ...............................................................................................................................................................

4

4. Exemption amount as computed above ................................................................................................................................................................

Place

5

5. Taxable net income (Subtract line 4 from line 3. GO TO TAX TABLE) .....................................................................................................................

ChECk

6

6. Maryland tax from Tax Table .................................................................................................................................................................................

or

MONEy

7

7. Earned income credit

7a

7b

Poverty level credit

(See Instruction 18) Total ....................

ORDER

8

8. Maryland tax after credits (Subtract line 7 from line 6) If less than 0, enter 0. ...................................................................................................

on top of

.

your W-2

0

___ ___ ___ ___ ........................

9

9. Local tax (See Instruction 19 for tax rates and worksheet.) Multiply line 5 by your local tax rate

wage and

10

tax

10a

10. Local: Earned income credit

Poverty level credit

10b

(See Instruction 19) Total ..................

statements

11

11. Local tax after credits (Subtract line 10 from line 9) If less than 0, enter 0. ........................................................................................................

and

ATTACh

12

12. Total Maryland and local tax (Add lines 8 and 11) ................................................................................................................................................

hERE

13

13. Contributions to Chesapeake Bay and Endangered Species Fund .........................................................................................................................

with ONE

staple.

14

14. Contributions to Developmental Disabilities Waiting List Equity Fund ....................................................................................................................

15

15. Contributions to Maryland Cancer Fund ................................................................................................................................................................

16

16. Total Maryland income tax, local income tax and contributions (Add lines 12 through 15) ...........................................................................

17

17. Total Maryland and local tax withheld (Enter total from and attach your W-2 and 1099 forms if MD tax is withheld) ..........................................

18

18. Refundable earned income credit (from worksheet in Instruction 21) ...................................................................................................................

19

19. Total payments and credit (Add lines 17 and 18) .................................................................................................................................................

20

20. Balance due (If line 16 is more than line 19, subtract line 19 from line 16) .........................................................................................................

REFUND

21

21. Overpayment (If line 16 is less than line 19, subtract line 16 from line 19) See line 24 .............................................. This is your

22

22. Interest charges from Form 502UP

or for late filing

(See Instruction 22) Total . . . . . . . . . . . . . . . .

23

23. TOTAL AMOUNT DUE (Add lines 20 and 22) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . IF $1 OR MORE, PAY IN FULL WITH THIS RETURN

COM/RAD-020

11-49

1

1 2

2