Utah State Temporary Sales Tax Application - Tax Commission

ADVERTISEMENT

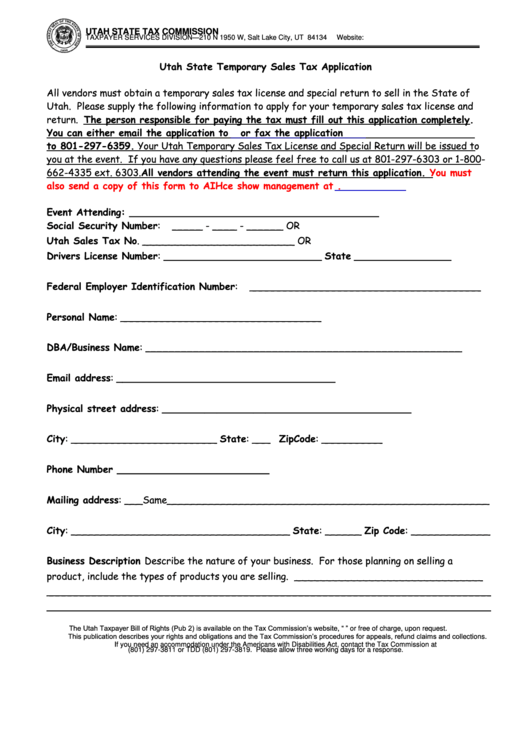

UTAH STATE TAX COMMISSION

TAXPAYER SERVICES DIVISION—210 N 1950 W, Salt Lake City, UT 84134

Website:

Utah State Temporary Sales Tax Application

All vendors must obtain a temporary sales tax license and special return to sell in the State of

Utah. Please supply the following information to apply for your temporary sales tax license and

return. The person responsible for paying the tax must fill out this application completely.

You can either email the application to

SPECIALEVENT@UTAH.GOV

or fax the application

to 801-297-6359. Your Utah Temporary Sales Tax License and Special Return will be issued to

you at the event. If you have any questions please feel free to call us at 801-297-6303 or 1-800-

662-4335 ext. 6303. All vendors attending the event must return this application.

You must

also send a copy of this form to AIHce show management at .

Event Attending: _________________________________________

Social Security Number:

_____ - ____ - ______ OR

Utah Sales Tax No. _________________________ OR

Drivers License Number: __________________________ State ________________

Federal Employer Identification Number:

______________________________________

Personal Name: _________________________________

DBA/Business Name: ____________________________________________________

Email address: ____________________________________

Physical street address: _________________________________________

City: ________________________ State: ___ Zip Code: __________

Phone Number _________________________

Mailing address: ___Same_____________________________________________________

City: ____________________________________ State: ______ Zip Code: _____________

Business Description Describe the nature of your business. For those planning on selling a

product, include the types of products you are selling. _______________________________

_________________________________________________________________________

_________________________________________________________________________

The Utah Taxpayer Bill of Rights (Pub 2) is available on the Tax Commission’s website, “tax.utah.gov” or free of charge, upon request.

This publication describes your rights and obligations and the Tax Commission’s procedures for appeals, refund claims and collections.

If you need an accommodation under the Americans with Disabilities Act, contact the Tax Commission at

(801) 297-3811 or TDD (801) 297-3819. Please allow three working days for a response.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1