Form De 1964 - Claim For Refund Of Excess California State Disability Insurance Deductions - Ca Employment Development Dept.

ADVERTISEMENT

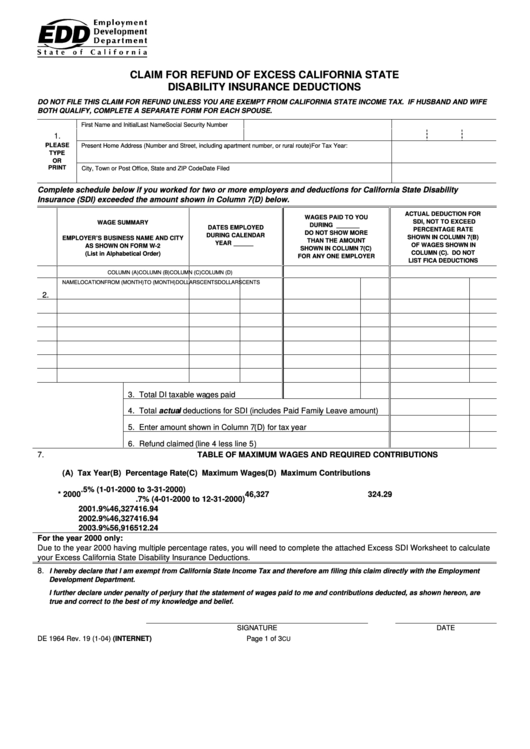

CLAIM FOR REFUND OF EXCESS CALIFORNIA STATE

DISABILITY INSURANCE DEDUCTIONS

DO NOT FILE THIS CLAIM FOR REFUND UNLESS YOU ARE EXEMPT FROM CALIFORNIA STATE INCOME TAX. IF HUSBAND AND WIFE

BOTH QUALIFY, COMPLETE A SEPARATE FORM FOR EACH SPOUSE.

First Name and Initial

Last Name

Social Security Number

1.

PLEASE

Present Home Address (Number and Street, including apartment number, or rural route)

For Tax Year:

TYPE

OR

PRINT

City, Town or Post Office, State and ZIP Code

Date Filed

Complete schedule below if you worked for two or more employers and deductions for California State Disability

Insurance (SDI) exceeded the amount shown in Column 7(D) below.

ACTUAL DEDUCTION FOR

WAGES PAID TO YOU

SDI, NOT TO EXCEED

WAGE SUMMARY

DURING _______

DATES EMPLOYED

PERCENTAGE RATE

DO NOT SHOW MORE

DURING CALENDAR

SHOWN IN COLUMN 7(B)

EMPLOYER’S BUSINESS NAME AND CITY

THAN THE AMOUNT

YEAR ______

OF WAGES SHOWN IN

AS SHOWN ON FORM W-2

SHOWN IN COLUMN 7(C)

COLUMN (C). DO NOT

(List in Alphabetical Order)

FOR ANY ONE EMPLOYER

LIST FICA DEDUCTIONS

COLUMN (A)

COLUMN (B)

COLUMN (C)

COLUMN (D)

NAME

LOCATION

FROM (MONTH)

TO (MONTH)

DOLLARS

CENTS

DOLLARS

CENTS

2.

3. Total DI taxable wages paid

4. Total actual deductions for SDI (includes Paid Family Leave amount)

5. Enter amount shown in Column 7(D) for tax year

6. Refund claimed (line 4 less line 5)

7.

TABLE OF MAXIMUM WAGES AND REQUIRED CONTRIBUTIONS

(A) Tax Year

(B) Percentage Rate

(C) Maximum Wages

(D) Maximum Contributions

.5% (1-01-2000 to 3-31-2000)

*

2000

46,327

324.29

.7% (4-01-2000 to 12-31-2000)

2001

.9%

46,327

416.94

2002

.9%

46,327

416.94

2003

.9%

56,916

512.24

For the year 2000 only:

Due to the year 2000 having multiple percentage rates, you will need to complete the attached Excess SDI Worksheet to calculate

your Excess California State Disability Insurance Deductions.

8.

I hereby declare that I am exempt from California State Income Tax and therefore am filing this claim directly with the Employment

Development Department.

I further declare under penalty of perjury that the statement of wages paid to me and contributions deducted, as shown hereon, are

true and correct to the best of my knowledge and belief.

SIGNATURE

DATE

DE 1964 Rev. 19 (1-04) (INTERNET)

Page 1 of 3

CU

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3