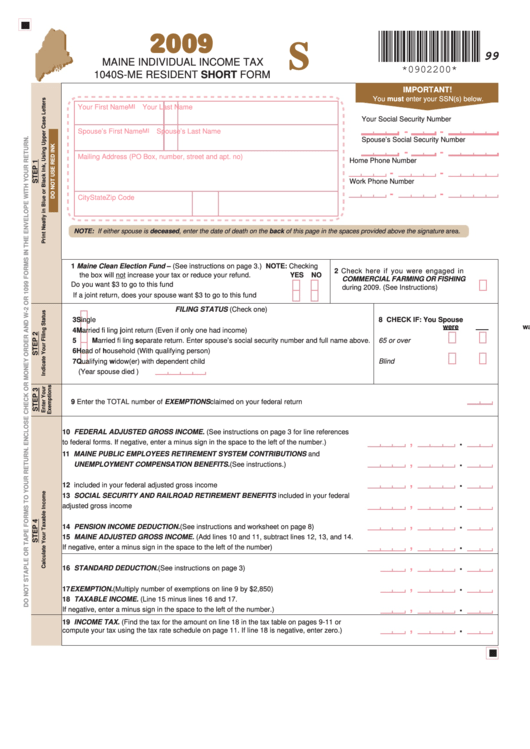

1040s-Me Resident Short Form - Maine Individual Income Tax - Maine Revenue Services - 2009

ADVERTISEMENT

2009

S

99

MAINE INDIVIDUAL INCOME TAX

*0902200*

1040S-ME RESIDENT SHORT FORM

IMPORTANT!

You must enter your SSN(s) below.

Your First Name

MI

Your Last Name

Your Social Security Number

-

-

Spouse’s First Name

MI

Spouse’s Last Name

Spouse’s Social Security Number

-

-

Mailing Address (PO Box, number, street and apt. no)

Home Phone Number

-

-

Work Phone Number

-

-

City

State

Zip Code

NOTE: If either spouse is deceased, enter the date of death on the back of this page in the spaces provided above the signature area.

1 Maine Clean Election Fund – (See instructions on page 3.) NOTE: Checking

2 Check here if you were engaged in

the box will not increase your tax or reduce your refund.

YES

NO

COMMERCIAL FARMING OR FISHING

Do you want $3 to go to this fund ........................................................

during 2009. (See Instructions) .................

If a joint return, does your spouse want $3 to go to this fund ..............

FILING STATUS (Check one)

3

Single

8 CHECK IF:

You

Spouse

were

was

4

Married fi ling joint return (Even if only one had income)

5

Married fi ling separate return. Enter spouse’s social security number and full name above.

65 or over ............. 8a

8c

6

Head of household (With qualifying person)

7

Qualifying widow(er) with dependent child

Blind...................... 8b

8d

(Year spouse died

)

9

Enter the TOTAL number of EXEMPTIONS claimed on your federal return .............................................................................. 9

10 FEDERAL ADJUSTED GROSS INCOME. (See instructions on page 3 for line references

,

.

to federal forms. If negative, enter a minus sign in the space to the left of the number.) ......... 10

11 MAINE PUBLIC EMPLOYEES RETIREMENT SYSTEM CONTRIBUTIONS and

,

.

UNEMPLOYMENT COMPENSATION BENEFITS. (See instructions.) ...................................11

,

.

12 U.S. GOVERNMENT BOND INTEREST included in your federal adjusted gross income ...... 12

13 SOCIAL SECURITY AND RAILROAD RETIREMENT BENEFITS included in your federal

,

.

adjusted gross income ............................................................................................................. 13

,

.

14 PENSION INCOME DEDUCTION. (See instructions and worksheet on page 8) ................... 14

15 MAINE ADJUSTED GROSS INCOME. (Add lines 10 and 11, subtract lines 12, 13, and 14.

,

.

If negative, enter a minus sign in the space to the left of the number) ..................................... 15

,

.

16 STANDARD DEDUCTION. (See instructions on page 3) ...............................................................16

,

.

17 EXEMPTION. (Multiply number of exemptions on line 9 by $2,850) ...............................................17

18 TAXABLE INCOME. (Line 15 minus lines 16 and 17.

,

.

If negative, enter a minus sign in the space to the left of the number.) ...........................................18

19 INCOME TAX. (Find the tax for the amount on line 18 in the tax table on pages 9-11 or

,

.

compute your tax using the tax rate schedule on page 11. If line 18 is negative, enter zero.) ........19

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2