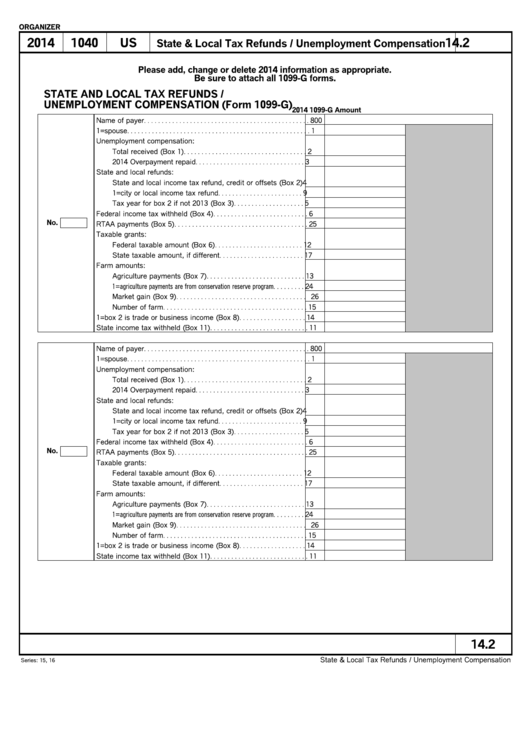

Form 1099-G - State & Local Tax Refunds / Unemployment Compensation - 2014

ADVERTISEMENT

ORGANIZER

2014

1040

US

14.2

State & Local Tax Refunds / Unemployment Compensation

Please add, change or delete 2014 information as appropriate.

Be sure to attach all 1099-G forms.

STATE AND LOCAL TAX REFUNDS /

UNEMPLOYMENT COMPENSATION (Form 1099-G)

2014 1099-G Amount

Name of payer

800

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1=spouse

1

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Unemployment compensation:

Total received (Box 1)

2

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2014 Overpayment repaid

3

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

State and local refunds:

State and local income tax refund, credit or offsets (Box 2)

4

1=city or local income tax refund

9

. . . . . . . . . . . . . . . . . . . . . . . .

Tax year for box 2 if not 2013 (Box 3)

5

. . . . . . . . . . . . . . . . . . . .

Federal income tax withheld (Box 4)

6

. . . . . . . . . . . . . . . . . . . . . . . . . . .

No.

RTAA payments (Box 5)

25

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Taxable grants:

Federal taxable amount (Box 6)

12

. . . . . . . . . . . . . . . . . . . . . . . . .

State taxable amount, if different

17

. . . . . . . . . . . . . . . . . . . . . . . .

Farm amounts:

Agriculture payments (Box 7)

13

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

1=agriculture payments are from conservation reserve program

24

. . . . . . . . .

Market gain (Box 9)

26

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Number of farm

15

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1=box 2 is trade or business income (Box 8)

14

. . . . . . . . . . . . . . . . . . .

State income tax withheld (Box 11)

11

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

Name of payer

800

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1=spouse

1

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Unemployment compensation:

Total received (Box 1)

2

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2014 Overpayment repaid

3

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

State and local refunds:

State and local income tax refund, credit or offsets (Box 2)

4

1=city or local income tax refund

9

. . . . . . . . . . . . . . . . . . . . . . . .

Tax year for box 2 if not 2013 (Box 3)

5

. . . . . . . . . . . . . . . . . . . .

Federal income tax withheld (Box 4)

6

. . . . . . . . . . . . . . . . . . . . . . . . . . .

No.

RTAA payments (Box 5)

25

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Taxable grants:

Federal taxable amount (Box 6)

12

. . . . . . . . . . . . . . . . . . . . . . . . .

State taxable amount, if different

17

. . . . . . . . . . . . . . . . . . . . . . . .

Farm amounts:

Agriculture payments (Box 7)

13

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

1=agriculture payments are from conservation reserve program

24

. . . . . . . . .

Market gain (Box 9)

26

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Number of farm

15

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1=box 2 is trade or business income (Box 8)

14

. . . . . . . . . . . . . . . . . . .

State income tax withheld (Box 11)

11

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

14.2

State & Local Tax Refunds / Unemployment Compensation

Series: 15, 16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1