Instructions For Form Nyc-115 - Unincorporated Business Tax Report Of Change In Taxable Income - 2010

ADVERTISEMENT

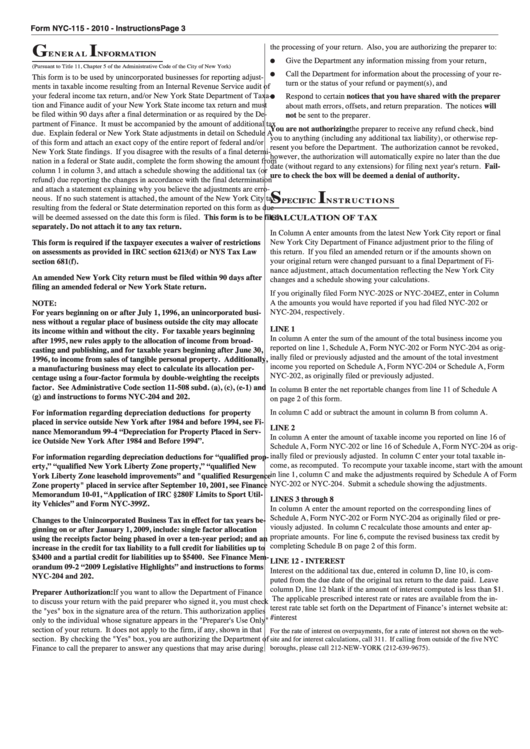

Form NYC-115 - 2010 - Instructions

G

I

Page 3

the processing of your return. Also, you are authorizing the preparer to:

E N E R A L

N F O R M AT I O N

Give the Department any information missing from your return,

G

(Pursuant to Title 11, Chapter 5 of the Administrative Code of the City of New York)

Call the Department for information about the processing of your re-

This form is to be used by unincorporated businesses for reporting adjust-

turn or the status of your refund or payment(s), and

G

ments in taxable income resulting from an Internal Revenue Service audit of

your federal income tax return, and/or New York State Department of Taxa-

Respond to certain notices that you have shared with the preparer

tion and Finance audit of your New York State income tax return and must

about math errors, offsets, and return preparation. The notices will

G

be filed within 90 days after a final determination or as required by the De-

not be sent to the preparer.

partment of Finance. It must be accompanied by the amount of additional tax

You are not authorizing the preparer to receive any refund check, bind

due. Explain federal or New York State adjustments in detail on Schedule A

you to anything (including any additional tax liability), or otherwise rep-

of this form and attach an exact copy of the entire report of federal and/or

resent you before the Department. The authorization cannot be revoked,

New York State findings. If you disagree with the results of a final determi-

however, the authorization will automatically expire no later than the due

nation in a federal or State audit, complete the form showing the amount from

date (without regard to any extensions) for filing next year's return. Fail-

column 1 in column 3, and attach a schedule showing the additional tax (or

ure to check the box will be deemed a denial of authority.

S

I

refund) due reporting the changes in accordance with the final determination

and attach a statement explaining why you believe the adjustments are erro-

neous. If no such statement is attached, the amount of the New York City tax

P E C I F I C

N S T R U C T I O N S

resulting from the federal or State determination reported on this form as due

will be deemed assessed on the date this form is filed. This form is to be filed

CALCULATION OF TAX

separately. Do not attach it to any tax return.

In Column A enter amounts from the latest New York City report or final

This form is required if the taxpayer executes a waiver of restrictions

New York City Department of Finance adjustment prior to the filing of

on assessments as provided in IRC section 6213(d) or NYS Tax Law

this return. If you filed an amended return or if the amounts shown on

section 681(f).

your original return were changed pursuant to a final Department of Fi-

nance adjustment, attach documentation reflecting the New York City

An amended New York City return must be filed within 90 days after

changes and a schedule showing your calculations.

filing an amended federal or New York State return.

If you originally filed Form NYC-202S or NYC-204EZ, enter in Column

NOTE:

A the amounts you would have reported if you had filed NYC-202 or

For years beginning on or after July 1, 1996, an unincorporated busi-

NYC-204, respectively.

ness without a regular place of business outside the city may allocate

LINE 1

its income within and without the city. For taxable years beginning

In column A enter the sum of the amount of the total business income you

after 1995, new rules apply to the allocation of income from broad-

reported on line 1, Schedule A, Form NYC-202 or Form NYC-204 as orig-

casting and publishing, and for taxable years beginning after June 30,

inally filed or previously adjusted and the amount of the total investment

1996, to income from sales of tangible personal property. Additionally,

income you reported on Schedule A, Form NYC-204 or Schedule A, Form

a manufacturing business may elect to calculate its allocation per-

NYC-202, as originally filed or previously adjusted.

centage using a four-factor formula by double-weighting the receipts

factor. See Administrative Code section 11-508 subd. (a), (c), (e-1) and

In column B enter the net reportable changes from line 11 of Schedule A

(g) and instructions to forms NYC-204 and 202.

on page 2 of this form.

For information regarding depreciation deductions for property

In column C add or subtract the amount in column B from column A.

placed in service outside New York after 1984 and before 1994, see Fi-

LINE 2

nance Memorandum 99-4 “Depreciation for Property Placed in Serv-

In column A enter the amount of taxable income you reported on line 16 of

ice Outside New York After 1984 and Before 1994”.

Schedule A, Form NYC-202 or line 16 of Schedule A, Form NYC-204 as orig-

inally filed or previously adjusted. In column C enter your total taxable in-

For information regarding depreciation deductions for “qualified prop-

come, as recomputed. To recompute your taxable income, start with the amount

erty,” “qualified New York Liberty Zone property,” “qualified New

in line 1, column C and make the adjustments required by Schedule A of Form

York Liberty Zone leasehold improvements” and "qualified Resurgence

NYC-202 or NYC-204. Submit a schedule showing the adjustments.

Zone property" placed in service after September 10, 2001, see Finance

Memorandum 10-01, “Application of IRC §280F Limits to Sport Util-

LINES 3 through 8

ity Vehicles” and Form NYC-399Z.

In column A enter the amount reported on the corresponding lines of

Schedule A, Form NYC-202 or Form NYC-204 as originally filed or pre-

Changes to the Unincorporated Business Tax in effect for tax years be-

viously adjusted. In column C recalculate those amounts and enter ap-

ginning on or after January 1, 2009, include: single factor allocation

propriate amounts. For line 6, compute the revised business tax credit by

using the receipts factor being phased in over a ten-year period; and an

completing Schedule B on page 2 of this form.

increase in the credit for tax liability to a full credit for liabilities up to

$3400 and a partial credit for liabilities up to $5400. See Finance Mem-

LINE 12 - INTEREST

orandum 09-2 “2009 Legislative Highlights” and instructions to forms

Interest on the additional tax due, entered in column D, line 10, is com-

NYC-204 and 202.

puted from the due date of the original tax return to the date paid. Leave

column D, line 12 blank if the amount of interest computed is less than $1.

Preparer Authorization: If you want to allow the Department of Finance

The applicable prescribed interest rate or rates are available from the in-

to discuss your return with the paid preparer who signed it, you must check

terest rate table set forth on the Department of Finance’s internet website at:

the "yes" box in the signature area of the return. This authorization applies

only to the individual whose signature appears in the "Preparer's Use Only"

section of your return. It does not apply to the firm, if any, shown in that

For the rate of interest on overpayments, for a rate of interest not shown on the web-

section. By checking the "Yes" box, you are authorizing the Department of

site and for interest calculations, call 311. If calling from outside of the five NYC

Finance to call the preparer to answer any questions that may arise during

boroughs, please call 212-NEW-YORK (212-639-9675).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2