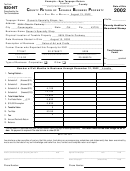

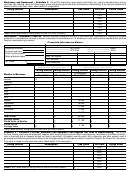

Tax Forms 920-Nt Examples - County Return Of Taxable Business Property, 921-Nt - Ohio Balance Sheet - 2002

ADVERTISEMENT

Instructions for New Taxpayer Return

Any person, partnership, corporation or association who en-

numerator of the fraction is the number of full months from

gages in business in Ohio on or after January 1 of any year is

the date of engaging in business to December 31, the de-

a “new taxpayer” for that year. Whenever a taxpayer ceases

nominator is twelve. This is the value to which the tax rates

business in Ohio, and in a subsequent year begins business

are applied to determine the amount of tax owed.

in Ohio again, he is a new taxpayer for that year. The new

taxpayer is liable for a property tax return in the year in which

Acquisition of Existing Business – When a new taxpayer

he commences business in Ohio. The total listed value is

has acquired an existing business and that business has filed

prorated based on the number of full months in business in

a personal property tax return for the same year in which the

Ohio in that first year.

new taxpayer acquires the business, taxes for property that

was listed by the former owner need not be paid again by the

Filing Due Dates – The new taxpayer return (920-NT) is to

new taxpayer. The new taxpayer must produce a copy of the

be filed with the county auditor within 90 days of first engag-

return or assessment indicating that the same property has

ing in business in Ohio. An extension of time of up to 45

been listed or assessed for taxation for the same year The

additional days may be requested from the county auditor by

amount of inventory which may be excluded is the lower of

written application. This return (920-NT) is for the year in which

the average amount listed by the former owner in his return

the business commenced in Ohio, even if it is not required to

for the same year, or the amount transferred. Any property

be filed until the next calendar year.

not listed in the former owner’s return and acquired prior to

the new taxpayer’s first day of business must be listed. Aver-

Late Filing – If the return is not timely filed, the assessor will

age inventory in excess of the amount excludable must also

add a penalty of up to 50% of the taxable value plus loss of ½

be listed.

of the $10,000 exemption.

Reorganization – Frequently, an existing business that had

The next tax return required to be filed is for the calendar

been organized as a proprietorship or partnership will be re-

year following the year in which the business began. This

organized as a corporation, or other changes in the business

return is due in the normal filing period of February 15 through

structure take place that result in the existence of a new en-

April 30. All taxable property in this year’s return must be

tity. In these circumstances, the new owner or business en-

listed as of the close of business on December 31 of the

tity is considered a new taxpayer and required to file a new

preceding calendar year (the year engaged in business). In-

return for the year in which the change took place. These

ventory is listed at the average of the month-end values for

new taxpayers are subject to the same reporting requirements

each of the months that the taxpayer was engaged in busi-

as those beginning a new business. A copy of the return filed

ness in that year. Use the number of month-end values in-

for the same year by the former entity should be included

cluded as the divisor. Listed values in this year’s return may

with the new taxpayer return.

not be prorated.

Alternate Listing Date – Rule 5703-3-04, Ohio Administra-

1st Day of Business – The date of engaging in business

tive Code, provides for the use of listing dates other than

has been generally defined as the day the business com-

December 31. Before a listing date other than December 31

mences operations, which is not necessarily the day the busi-

may be used, the taxpayer must be engaged in business for

ness was organized or licensed in Ohio. In the case of a

at least twelve months prior to that listing date. In certain

merchant, the day that the business opened for the purpose

instances, where property may be excluded from taxation for

of selling merchandise would be the first day of business. In

a year, or taxed twice in a year, the Tax Commissioner may

the case of a manufacturer, it would be the first day that pro-

authorize or require an alternate listing date for a taxpayer to

duction started. For other business activities, the first day of

exclude or to report property involved in a change of owner-

business would be the day that the intended business activ-

ship. These circumstances may affect the new taxpayer’s

ity started.

return when an entire business or facility is acquired.

Listing Date – For the new taxpayer return, the listing date is

Listing and Valuing Personal Property

the first day of business in Ohio instead of December 31 or a

fiscal year end. All taxable property, except inventory, owned

Personal Property is every tangible thing which is owned,

on the first day of business must be listed, the true value is

except real property. Real Property is defined as land, grow-

the taxpayer’s cost. Inventory must be listed at the average

ing crops, all buildings, structures, improvements and fixtures

value for the remainder of the year. Estimate month-end val-

on the land.

ues starting with the end of the month engaging in business

and for each month-end throughout the remainder of the year.

Tangible personal property used in business in Ohio is taxed.

If additional locations will be opened later in the year, inven-

This includes machinery and equipment, furniture and fix-

tory for those locations must also be estimated for the new

tures, small tools, supplies and inventory held for manufac-

taxpayer return. The average value is the sum of the month-

ture or resale.

end values divided by the number of month-end values in-

cluded. The estimated values reported may be amended at

$10,000 Exemption – The first $10,000 of listed value of

a later date, when actual month-end inventory values are

taxable personal property owned by a taxpayer is exempt

known.

from taxation to the owner. The exemption is applied in the

taxing district with the highest listed value. If that is less than

Prorating – The total listed value of the return is multiplied

$10,000, the remaining amount is applied in the taxing dis-

by a fraction which represents the portion of the year during

trict with the next highest value until either the $10,000 ex-

which the taxpayer will be engaged in business in Ohio. The

emption is exhausted or a net taxable value of zero is reached.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5