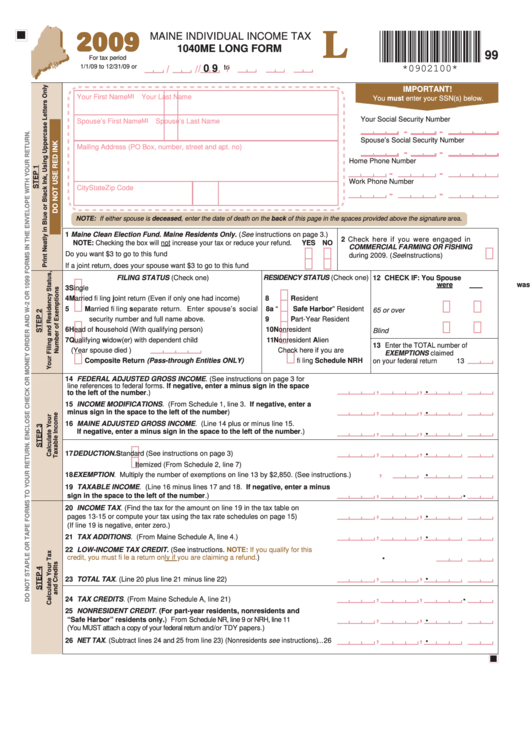

Form 1040me L - Maine Individual Income Tax - Long Form - 2009

ADVERTISEMENT

2009

L

MAINE INDIVIDUAL INCOME TAX

1040ME LONG FORM

99

For tax period

1/1/09 to 12/31/09 or

0 9

to

/

/

/

/

*0902100*

IMPORTANT!

Your First Name

MI

Your Last Name

You must enter your SSN(s) below.

Your Social Security Number

Spouse’s First Name

MI

Spouse’s Last Name

-

-

Spouse’s Social Security Number

Mailing Address (PO Box, number, street and apt. no)

-

-

Home Phone Number

-

-

Work Phone Number

City

State

Zip Code

-

-

NOTE: If either spouse is deceased, enter the date of death on the back of this page in the spaces provided above the signature area.

1 Maine Clean Election Fund. Maine Residents Only. (See instructions on page 3.)

2 Check here if you were engaged in

NOTE: Checking the box will not increase your tax or reduce your refund.

YES NO

COMMERCIAL FARMING OR FISHING

Do you want $3 to go to this fund ...............................................................

during 2009. (See Instructions) .................

If a joint return, does your spouse want $3 to go to this fund .....................

FILING STATUS (Check one)

RESIDENCY STATUS (Check one)

12 CHECK IF:

You

Spouse

were

was

3

Single

4

Married fi ling joint return (Even if only one had income)

8

Resident

5

Married fi ling separate return. Enter spouse’s social

8a

“Safe Harbor” Resident

65 or over ........... 12a

12c

security number and full name above.

9

Part-Year Resident

6

Head of household (With qualifying person)

10

Nonresident

Blind.................... 12b

12d

7

Qualifying widow(er) with dependent child

11

Nonresident Alien

13 Enter the TOTAL number of

(Year spouse died

)

Check here if you are

EXEMPTIONS claimed

Composite Return (Pass-through Entities ONLY)

fi ling Schedule NRH

on your federal return ....13

14 FEDERAL ADJUSTED GROSS INCOME. (See instructions on page 3 for

line references to federal forms. If negative, enter a minus sign in the space

,

,

.

to the left of the number.) .................................................................................... 14

15 INCOME MODIFICATIONS. (From Schedule 1, line 3. If negative, enter a

,

,

.

minus sign in the space to the left of the number) ........................................... 15

16 MAINE ADJUSTED GROSS INCOME. (Line 14 plus or minus line 15.

,

,

.

If negative, enter a minus sign in the space to the left of the number.) .......... 16

,

,

.

17 DEDUCTION.

Standard (See instructions on page 3) ................................ 17

Itemized (From Schedule 2, line 7)

,

.

18 EXEMPTION. Multiply the number of exemptions on line 13 by $2,850. (See instructions.) .............. 18

19 TAXABLE INCOME. (Line 16 minus lines 17 and 18. If negative, enter a minus

,

,

.

sign in the space to the left of the number.) ...................................................... 19

20 INCOME TAX. (Find the tax for the amount on line 19 in the tax table on

,

,

.

pages 13-15 or compute your tax using the tax rate schedules on page 15) ........ 20

(If line 19 is negative, enter zero.)

,

,

.

21 TAX ADDITIONS. (From Maine Schedule A, line 4.) ............................................ 21

22 LOW-INCOME TAX CREDIT. (See instructions.

NOTE: If you qualify for this

.

credit, you must fi le a return only if you are claiming a

refund.) ................................................................................. 22

,

,

.

23 TOTAL TAX. (Line 20 plus line 21 minus line 22) .................................................. 23

,

,

.

24 TAX CREDITS. (From Maine Schedule A, line 21) ................................................ 24

25 NONRESIDENT CREDIT. (For part-year residents, nonresidents and

,

,

.

“Safe Harbor” residents only.) From Schedule NR, line 9 or NRH, line 11 ............ 25

(You MUST attach a copy of your federal return and/or TDY papers.)

,

,

.

26 NET TAX. (Subtract lines 24 and 25 from line 23) (Nonresidents see instructions) ... 26

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4