Declaration Of Estimated Tax For 2013 - City Of Centerville

ADVERTISEMENT

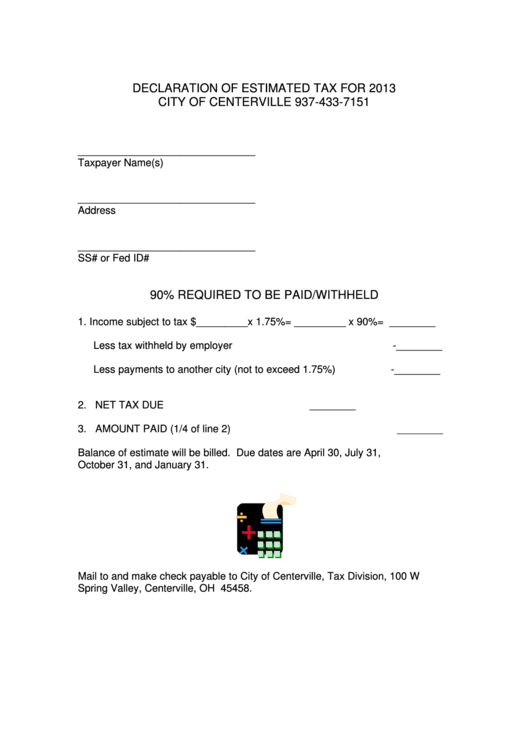

DECLARATION OF ESTIMATED TAX FOR 2013

CITY OF CENTERVILLE 937-433-7151

_______________________________

Taxpayer Name(s)

_______________________________

Address

_______________________________

SS# or Fed ID#

90% REQUIRED TO BE PAID/WITHHELD

1. Income subject to tax $_________x 1.75%= _________ x 90%= ________

Less tax withheld by employer

-________

Less payments to another city (not to exceed 1.75%)

-________

2. NET TAX DUE

________

3. AMOUNT PAID (1/4 of line 2)

________

Balance of estimate will be billed. Due dates are April 30, July 31,

October 31, and January 31.

Mail to and make check payable to City of Centerville, Tax Division, 100 W

Spring Valley, Centerville, OH 45458.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1