Business And Occupational Tax Report - City Of North Bend

ADVERTISEMENT

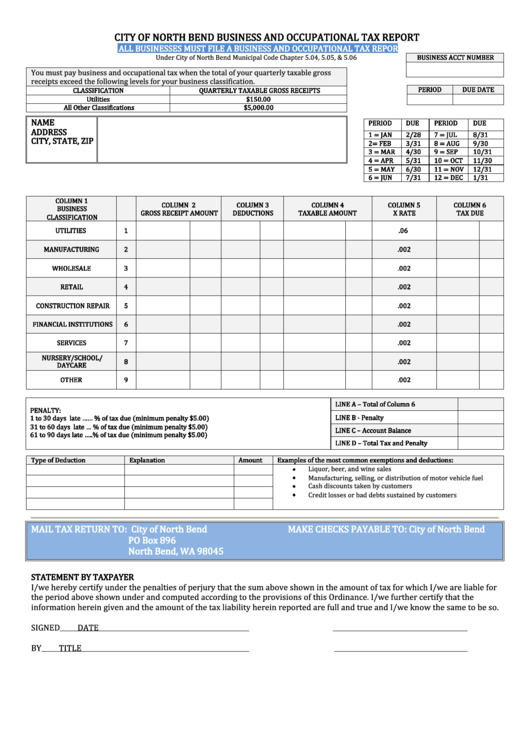

CITY OF NORTH BEND BUSINESS AND OCCUPATIONAL TAX REPORT

ALL BUSINESSES MUST FILE A BUSINESS AND OCCUPATIONAL TAX REPORT

Under City of North Bend Municipal Code Chapter 5.04, 5.05, & 5.06

BUSINESS ACCT NUMBER

You must pay business and occupational tax when the total of your quarterly taxable gross

receipts exceed the following levels for your business classification.

PERIOD

DUE DATE

CLASSIFICATION

QUARTERLY TAXABLE GROSS RECEIPTS

Utilities

$150.00

All Other Classifications

$5,000.00

NAME

PERIOD

DUE

PERIOD

DUE

ADDRESS

1 = JAN

2/28

7 = JUL

8/31

CITY, STATE, ZIP

2= FEB

3/31

8 = AUG

9/30

3 = MAR

4/30

9 = SEP

10/31

4 = APR

5/31

10 = OCT

11/30

5 = MAY

6/30

11 = NOV

12/31

6 = JUN

7/31

12 = DEC

1/31

COLUMN 1

COLUMN 2

COLUMN 3

COLUMN 4

COLUMN 5

COLUMN 6

BUSINESS

GROSS RECEIPT AMOUNT

DEDUCTIONS

TAXABLE AMOUNT

X RATE

TAX DUE

CLASSIFICATION

UTILITIES

1

.06

MANUFACTURING

2

.002

WHOLESALE

3

.002

RETAIL

4

.002

CONSTRUCTION REPAIR

5

.002

FINANCIAL INSTITUTIONS

6

.002

SERVICES

7

.002

NURSERY/SCHOOL/

8

.002

DAYCARE

OTHER

9

.002

LINE A – Total of Column 6

PENALTY:

LINE B - Penalty

1 to 30 days late ……..add 5% of tax due (minimum penalty $5.00)

31 to 60 days late …...add 15% of tax due (minimum penalty $5.00)

LINE C – Account Balance

61 to 90 days late …....add 25% of tax due (minimum penalty $5.00)

LINE D – Total Tax and Penalty

Type of Deduction

Explanation

Amount

Examples of the most common exemptions and deductions:

Liquor, beer, and wine sales

Manufacturing, selling, or distribution of motor vehicle fuel

Cash discounts taken by customers

Credit losses or bad debts sustained by customers

MAIL TAX RETURN TO: City of North Bend

MAKE CHECKS PAYABLE TO: City of North Bend

PO Box 896

North Bend, WA 98045

STATEMENT BY TAXPAYER

I/we hereby certify under the penalties of perjury that the sum above shown in the amount of tax for which I/we are liable for

the period above shown under and computed according to the provisions of this Ordinance. I/we further certify that the

information herein given and the amount of the tax liability herein reported are full and true and I/we know the same to be so.

SIGNED

DATE

BY

TITLE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1