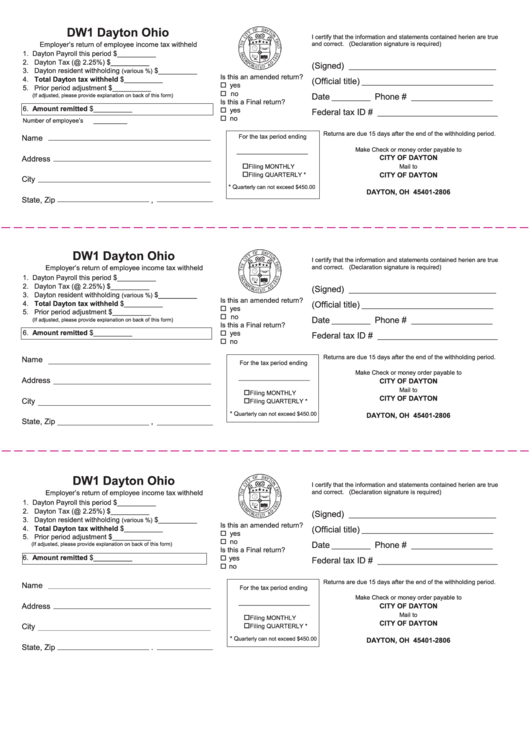

Form Dw1 - Employer'S Return Of Employee Income Tax Withheld - City Of Dayton - State Of Ohio

ADVERTISEMENT

DW1 Dayton Ohio

I certify that the information and statements contained herien are true

Employer’s return of employee income tax withheld

and correct. (Declaration signature is required)

1. Dayton Payroll this period

$__________

2. Dayton Tax (@ 2.25%)

$__________

(Signed)

______________________________________

3. Dayton resident withholding

$__________

(various %)

Is this an amended return?

4. Total Dayton tax withheld

$__________

(Official title)

__________________________________

o yes

5. Prior period adjustment

$__________

o no

Date

Phone #

(If adjusted, please provide explanation on back of this form)

__________

_____________________

Is this a Final return?

6. Amount remitted

$__________

o yes

Federal tax ID #

_______________________________

o no

Number of employee’s

__________

Returns are due 15 days after the end of the withholding period.

For the tax period ending

Name

Make Check or money order payable to

_____________________

CITY OF DAYTON

Address

o

Filing MONTHLY

Mail to

o

Filing QUARTERLY *

CITY OF DAYTON

City

P.O. BOX 2806

* Q

uarterly can not exceed $450.00

DAYTON, OH 45401-2806

State, Zip

,

DW1 Dayton Ohio

I certify that the information and statements contained herien are true

and correct. (Declaration signature is required)

Employer’s return of employee income tax withheld

1. Dayton Payroll this period

$__________

2. Dayton Tax (@ 2.25%)

$__________

(Signed)

______________________________________

3. Dayton resident withholding

$__________

(various %)

Is this an amended return?

4. Total Dayton tax withheld

$__________

(Official title)

__________________________________

o yes

5. Prior period adjustment

$__________

o no

Date

Phone #

__________

_____________________

(If adjusted, please provide explanation on back of this form)

Is this a Final return?

6. Amount remitted

$__________

o yes

Federal tax ID #

_______________________________

o no

Returns are due 15 days after the end of the withholding period.

Name

For the tax period ending

Make Check or money order payable to

_____________________

Address

CITY OF DAYTON

Mail to

o

Filing MONTHLY

CITY OF DAYTON

City

o

Filing QUARTERLY *

P.O. BOX 2806

* Q

uarterly can not exceed $450.00

DAYTON, OH 45401-2806

State, Zip

,

DW1 Dayton Ohio

I certify that the information and statements contained herien are true

Employer’s return of employee income tax withheld

and correct. (Declaration signature is required)

1. Dayton Payroll this period

$__________

2. Dayton Tax (@ 2.25%)

$__________

(Signed)

______________________________________

3. Dayton resident withholding

$__________

(various %)

Is this an amended return?

4. Total Dayton tax withheld

$__________

(Official title)

__________________________________

o yes

5. Prior period adjustment

$__________

o no

Date

Phone #

(If adjusted, please provide explanation on back of this form)

__________

_____________________

Is this a Final return?

6. Amount remitted

$__________

o yes

Federal tax ID #

_______________________________

o no

Returns are due 15 days after the end of the withholding period.

Name

For the tax period ending

Make Check or money order payable to

_____________________

Address

CITY OF DAYTON

Mail to

o

Filing MONTHLY

CITY OF DAYTON

o

City

Filing QUARTERLY *

P.O. BOX 2806

* Q

uarterly can not exceed $450.00

DAYTON, OH 45401-2806

State, Zip

.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1