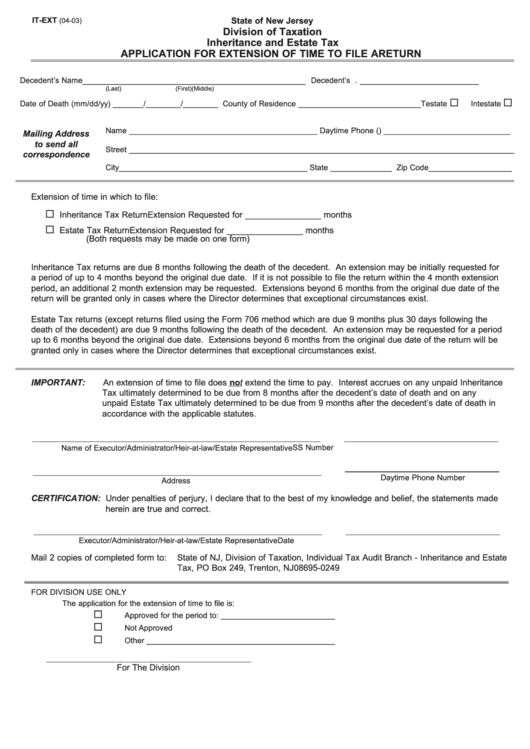

IT-EXT

State of New Jersey

(04-03)

Division of Taxation

Inheritance and Estate Tax

APPLICATION FOR EXTENSION OF TIME TO FILE A RETURN

_______________________________________________

. _________________________

Decedent’s Name

Decedent’s S.S. No

(Last)

(First)

(Middle)

Date of Death (mm/dd/yy) _______/________/________ County of Residence ____________________________ Testate

Intestate

Name ___________________________________________ Daytime Phone ( ) _____________________________

Mailing Address

to send all

Street ________________________________________________________________________________________

correspondence

City ___________________________________________ State ______________ Zip Code ___________________

Extension of time in which to file:

Inheritance Tax Return

Extension Requested for ________________ months

Estate Tax Return

Extension Requested for ________________ months

(Both requests may be made on one form)

Inheritance Tax returns are due 8 months following the death of the decedent. An extension may be initially requested for

a period of up to 4 months beyond the original due date. If it is not possible to file the return within the 4 month extension

period, an additional 2 month extension may be requested. Extensions beyond 6 months from the original due date of the

return will be granted only in cases where the Director determines that exceptional circumstances exist.

Estate Tax returns (except returns filed using the Form 706 method which are due 9 months plus 30 days following the

death of the decedent) are due 9 months following the death of the decedent. An extension may be requested for a period

up to 6 months beyond the original due date. Extensions beyond 6 months from the original due date of the return will be

granted only in cases where the Director determines that exceptional circumstances exist.

IMPORTANT:

An extension of time to file does not extend the time to pay. Interest accrues on any unpaid Inheritance

Tax ultimately determined to be due from 8 months after the decedent’s date of death and on any

unpaid Estate Tax ultimately determined to be due from 9 months after the decedent’s date of death in

accordance with the applicable statutes.

SS Number

Name of Executor/Administrator/Heir-at-law/Estate Representative

Daytime Phone Number

Address

CERTIFICATION: Under penalties of perjury, I declare that to the best of my knowledge and belief, the statements made

herein are true and correct.

Executor/Administrator/Heir-at-law/Estate Representative

Date

Mail 2 copies of completed form to:

State of NJ, Division of Taxation, Individual Tax Audit Branch - Inheritance and Estate

Tax, PO Box 249, Trenton, NJ 08695-0249

FOR DIVISION USE ONLY

The application for the extension of time to file is:

Approved for the period to: __________________________

Not Approved

Other ___________________________________________

For The Division

1

1