Form Su-102 - Use Tax Calculator - Wisconsin Departmentf Of Revenue

ADVERTISEMENT

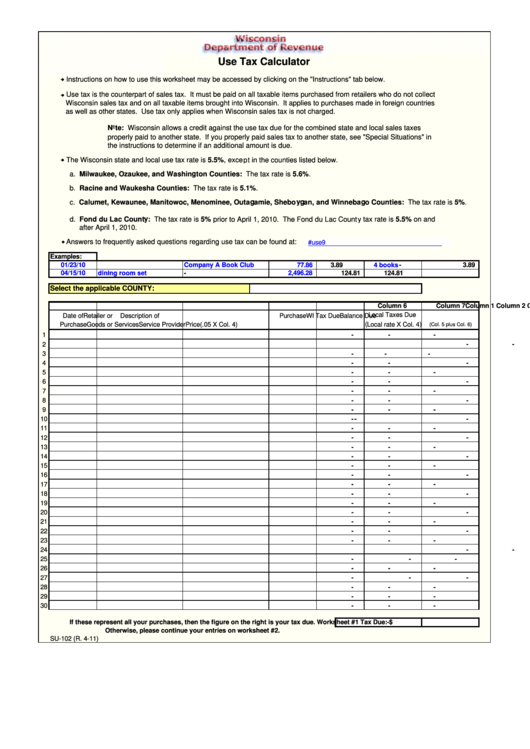

Use Tax Calculator

- Instructions on how to use this worksheet may be accessed by clicking on the "Instructions" tab below.

- Use tax is the counterpart of sales tax. It must be paid on all taxable items purchased from retailers who do not collect

Wisconsin sales tax and on all taxable items brought into Wisconsin. It applies to purchases made in foreign countries

as well as other states. Use tax only applies when Wisconsin sales tax is not charged.

Note: Wisconsin allows a credit against the use tax due for the combined state and local sales taxes

properly paid to another state. If you properly paid sales tax to another state, see "Special Situations" in

the instructions to determine if an additional amount is due.

- The Wisconsin state and local use tax rate is 5.5%, except in the counties listed below.

a. Milwaukee, Ozaukee, and Washington Counties: The tax rate is 5.6%.

b. Racine and Waukesha Counties: The tax rate is 5.1%.

c. Calumet, Kewaunee, Manitowoc, Menominee, Outagamie, Sheboygan, and Winnebago Counties: The tax rate is 5%.

d. Fond du Lac County: The tax rate is 5% prior to April 1, 2010. The Fond du Lac County tax rate is 5.5% on and

after April 1, 2010.

- Answers to frequently asked questions regarding use tax can be found at:

Examples:

01/23/10

4 books

Company A Book Club

77.86

3.89

-

3.89

04/15/10

dining room set

2,496.28

124.81

-

124.81

Select the applicable COUNTY:

Column 1

Column 2

Column 3

Column 4

Column 5

Column 6

Column 7

Local Taxes Due

Date of

Description of

Retailer or

Purchase

WI Tax Due

Balance Due

Purchase

Goods or Services

Service Provider

Price

(.05 X Col. 4) (Local rate X Col. 4)

(Col. 5 plus Col. 6)

1

-

-

-

-

-

-

2

3

-

-

-

4

-

-

-

5

-

-

-

6

-

-

-

7

-

-

-

8

-

-

-

9

-

-

-

-

-

-

10

11

-

-

-

12

-

-

-

13

-

-

-

14

-

-

-

15

-

-

-

16

-

-

-

17

-

-

-

-

-

-

18

19

-

-

-

20

-

-

-

21

-

-

-

22

-

-

-

23

-

-

-

24

-

-

-

25

-

-

-

-

-

-

26

27

-

-

-

28

-

-

-

-

-

-

29

30

-

-

-

Worksheet #1 Tax Due:

$

-

If these represent all your purchases, then the figure on the right is your tax due.

Otherwise, please continue your entries on worksheet #2.

SU-102 (R. 4-11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1