Form Mf-51 - Application For Motor Vehicle/special Fuel Tax Refund Permit

ADVERTISEMENT

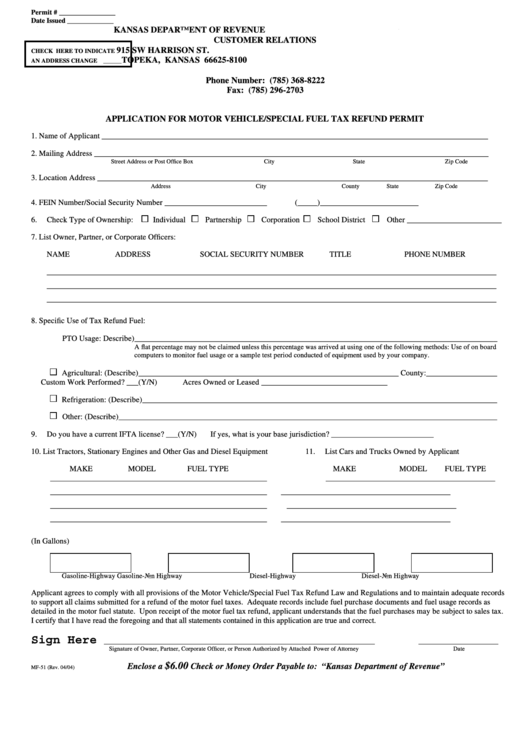

Permit # ________________

Date Issued _____________

KANSAS DEPARTMENT OF REVENUE

CUSTOMER RELATIONS

915 SW HARRISON ST.

CHECK HERE TO INDICATE

TOPEKA, KANSAS 66625-8100

AN ADDRESS CHANGE ______

Phone Number: (785) 368-8222

Fax: (785) 296-2703

APPLICATION FOR MOTOR VEHICLE/SPECIAL FUEL TAX REFUND PERMIT

1.

Name of Applicant __________________________________________________________________________________________________

2.

Mailing Address ____________________________________________________________________________________________________

Street Address or Post Office Box

City

State

Zip Code

3.

Location Address ___________________________________________________________________________________________________

Address

City

County

State

Zip Code

4.

FEIN Number/Social Security Number __________________________

5. Telephone Number (_____)_________________________

6.

Check Type of Ownership:

Individual

Partnership

Corporation

School District

Other ________________________

7.

List Owner, Partner, or Corporate Officers:

NAME

ADDRESS

SOCIAL SECURITY NUMBER

TITLE

PHONE NUMBER

__________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________

8.

Specific Use of Tax Refund Fuel:

PTO Usage: Describe)____________________________________________________________________________________________

A flat percentage may not be claimed unless this percentage was arrived at using one of the following methods: Use of on board

computers to monitor fuel usage or a sample test period conducted of equipment used by your company.

Agricultural: (Describe)__________________________________________________________________ County:__________________

Custom Work Performed? ___(Y/N)

Acres Owned or Leased ________________________________

Refrigeration: (Describe)__________________________________________________________________________________________

Other: (Describe)________________________________________________________________________________________________

9.

Do you have a current IFTA license? ___(Y/N)

If yes, what is your base jurisdiction? __________________________

10. List Tractors, Stationary Engines and Other Gas and Diesel Equipment

11.

List Cars and Trucks Owned by Applicant

MAKE

MODEL

FUEL TYPE

MAKE

MODEL

FUEL TYPE

_______________________________________________________

___________________________________________

_______________________________________________________

___________________________________________

_______________________________________________________

___________________________________________

_______________________________________________________

___________________________________________

12.

Bulk Fuel Storage (In Gallons)

Gasoline-Highway

Gasoline-Non Highway

Diesel-Highway

Diesel-Non Highway

Applicant agrees to comply with all provisions of the Motor Vehicle/Special Fuel Tax Refund Law and Regulations and to maintain adequate records

to support all claims submitted for a refund of the motor fuel taxes. Adequate records include fuel purchase documents and fuel usage records as

detailed in the motor fuel statute. Upon receipt of the motor fuel tax refund, applicant understands that the fuel purchases may be subject to sales tax.

I certify that I have read the foregoing and that all statements contained in this application are true and correct.

Sign Here

Signature of Owner, Partner, Corporate Officer, or Person Authorized by Attached Power of Attorney

Date

$6.00

Enclose a

Check or Money Order Payable to: “Kansas Department of Revenue”

MF-51 (Rev. 04/04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2