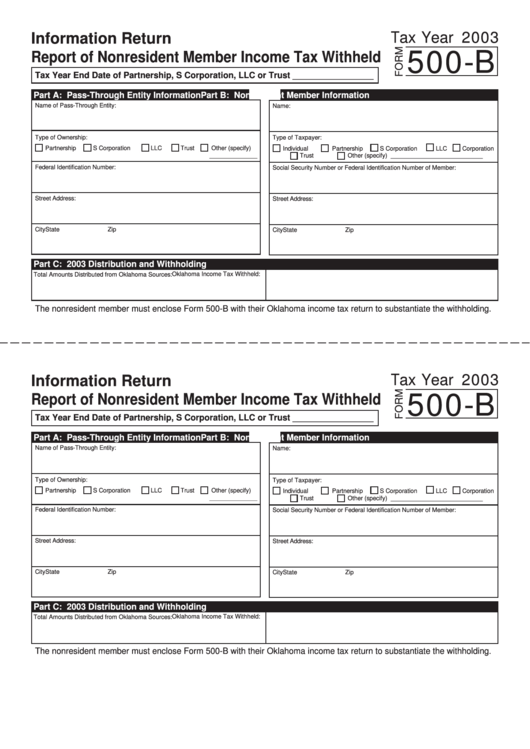

Form 500-B - Information Return Report Of Nonresident Member Income Tax Withheld - 2003

ADVERTISEMENT

Information Return

Tax Year 2003

Report of Nonresident Member Income Tax Withheld

500-B

Tax Year End Date of Partnership, S Corporation, LLC or Trust _________________

Part A: Pass-Through Entity Information

Part B: Nonresident Member Information

Name of Pass-Through Entity:

Name:

Type of Ownership:

Type of Taxpayer:

Partnership

S Corporation

LLC

Trust

Other (specify)

Individual

Partnership

S Corporation

LLC

Corporation

______________

Trust

Other (specify) ___________________________

Federal Identification Number:

Social Security Number or Federal Identification Number of Member:

Street Address:

Street Address:

City

State

Zip

City

State

Zip

Part C: 2003 Distribution and Withholding

Oklahoma Income Tax Withheld:

Total Amounts Distributed from Oklahoma Sources:

The nonresident member must enclose Form 500-B with their Oklahoma income tax return to substantiate the withholding.

Information Return

Tax Year 2003

Report of Nonresident Member Income Tax Withheld

500-B

Tax Year End Date of Partnership, S Corporation, LLC or Trust _________________

Part A: Pass-Through Entity Information

Part B: Nonresident Member Information

Name of Pass-Through Entity:

Name:

Type of Ownership:

Type of Taxpayer:

Partnership

S Corporation

LLC

Trust

Other (specify)

Individual

Partnership

S Corporation

LLC

Corporation

______________

Trust

Other (specify) ___________________________

Federal Identification Number:

Social Security Number or Federal Identification Number of Member:

Street Address:

Street Address:

City

State

Zip

City

State

Zip

Part C: 2003 Distribution and Withholding

Total Amounts Distributed from Oklahoma Sources:

Oklahoma Income Tax Withheld:

The nonresident member must enclose Form 500-B with their Oklahoma income tax return to substantiate the withholding.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1