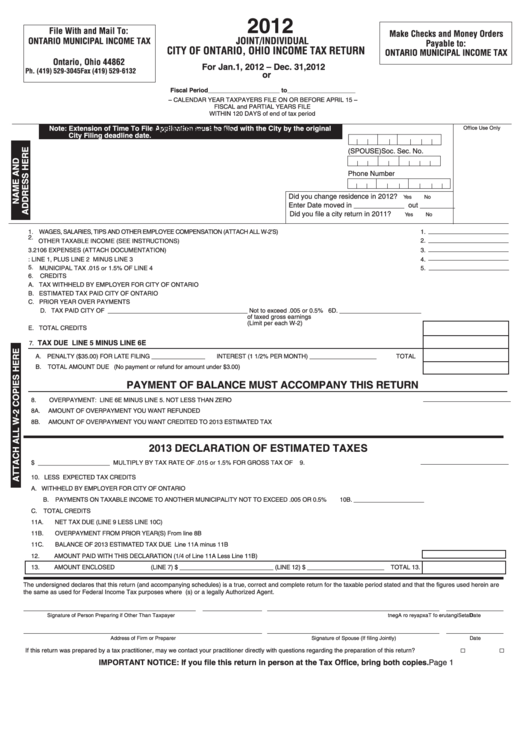

Joint/individual City Of Ontario, Ohio Income Tax Return - 2012

ADVERTISEMENT

2012

File With and Mail To:

Make Checks and Money Orders

JOINT/INDIVIDUAL

ONTARIO MUNICIPAL INCOME TAX

Payable to:

CITY OF ONTARIO, OHIO INCOME TAX RETURN

P.O. Box 166

ONTARIO MUNICIPAL INCOME TAX

Ontario, Ohio 44862

For Jan. 1, 2012 – Dec. 31, 2012

Ph. (419) 529-3045 Fax (419) 529-6132

or

Fiscal Period_____________________ to____________________

– CALENDAR YEAR TAXPAYERS FILE ON OR BEFORE APRIL 15 –

FISCAL and PARTIAL YEARS FILE

WITHIN 120 DAYS of end of tax period

Note: Extension of Time To File Application must be filed with the City by the original

Office Use Only

(TAXPAYER) Soc. Sec. No.

City Filing deadline date.

(SPOUSE) Soc. Sec. No.

Phone Number

Did you change residence in 2012?

Yes

No

Enter Date moved in _____________ out _________

Did you file a city return in 2011?

Yes

No

1. WAGES, SALARIES, TIPS AND OTHER EMPLOYEE COMPENSATION (ATTACH ALL W-2’S)

.........................................................................................

1.

2.

2.

OTHER TAXABLE INCOME (SEE INSTRUCTIONS) ...........................................................................................................................................

3. 2106 EXPENSES (ATTACH DOCUMENTATION) ................................................................................................................................................

3.

4. TAXABLE INCOME: LINE 1, PLUS LINE 2 MINUS LINE 3 ..................................................................................................................................

4.

5.

MUNICIPAL TAX .015 or 1.5% OF LINE 4 ..........................................................................................................................................................

5.

6.

CREDITS

A. TAX WITHHELD BY EMPLOYER FOR CITY OF ONTARIO .................................................................. 6A.________________________

B. ESTIMATED TAX PAID CITY OF ONTARIO .......................................................................................... 6B. ________________________

C. PRIOR YEAR OVER PAYMENTS .......................................................................................................... 6C. ________________________

D. TAX PAID CITY OF _________________________________________ Not to exceed .005 or 0.5% 6D. ________________________

of taxed gross earnings

(Limit per each W-2)

E. TOTAL CREDITS ................................................................................................................................................................................... 6E.

TAX DUE LINE 5 MINUS LINE 6E

7.

........................................................................................................................................................

7.

A. PENALTY ($35.00) FOR LATE FILING ________________

INTEREST (1 1/2% PER MONTH) ____________________

TOTAL

B.

TOTAL AMOUNT DUE ........................................................................................................

(No payment or refund for amount under $3.00)

PAYMENT OF BALANCE MUST ACCOMPANY THIS RETURN

8.

OVERPAYMENT: LINE 6E MINUS LINE 5. NOT LESS THAN ZERO ............................................................................................................. 8.

8A.

AMOUNT OF OVERPAYMENT YOU WANT REFUNDED ................................................................................. 8A. ___________________

8B.

AMOUNT OF OVERPAYMENT YOU WANT CREDITED TO 2013 ESTIMATED TAX ....................................... 8B. ___________________

2013 DECLARATION OF ESTIMATED TAXES

9. TOTAL INCOME SUBJECT TO TAX $ _____________________ MULTIPLY BY TAX RATE OF .015 or 1.5% FOR GROSS TAX OF

9.

10. LESS EXPECTED TAX CREDITS

A. WITHHELD BY EMPLOYER FOR CITY OF ONTARIO .................................................................................. 10A. _____________________

B. PAYMENTS ON TAXABLE INCOME TO ANOTHER MUNICIPALITY NOT TO EXCEED .005 OR 0.5%

10B. _____________________

C. TOTAL CREDITS ...........................................................................................................................................................................................10C. _________________________

11A.

NET TAX DUE (LINE 9 LESS LINE 10C) ................................................................................................................................................... 11A. _________________________

11B.

OVERPAYMENT FROM PRIOR YEAR(S) From line 8B .............................................................................................................................. 11B. _________________________

11C.

BALANCE OF 2013 ESTIMATED TAX DUE Line 11A minus 11B ............................................................................................................. 11C. _________________________

12.

AMOUNT PAID WITH THIS DECLARATION (1/4 of Line 11A Less Line 11B) ............................................................................................ 12.

13.

AMOUNT ENCLOSED

(LINE 7) $ ____________________________ (LINE 12) $ _______________________ TOTAL 13.

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and that the figures used herein are

the same as used for Federal Income Tax purposes where applicable. This Tax Return is Not Legally filed if not signed by the Taxpayer(s) or a legally Authorized Agent.

Signature of Person Preparing if Other Than Taxpayer

D

a

e t

S

g i

n

a

u t

e r

f o

a T

x

p

y a

r e

r o

A

g

e

t n

Date

Address of Firm or Preparer

Signature of Spouse (If filing Jointly)

Date

If this return was prepared by a tax practitioner, may we contact your practitioner directly with questions regarding the preparation of this return? .....................Yes

No

IMPORTANT NOTICE: If you file this return in person at the Tax Office, bring both copies.

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3