Form Xq-1 (B) - Estimated Tax Payment (Business) - 2012

ADVERTISEMENT

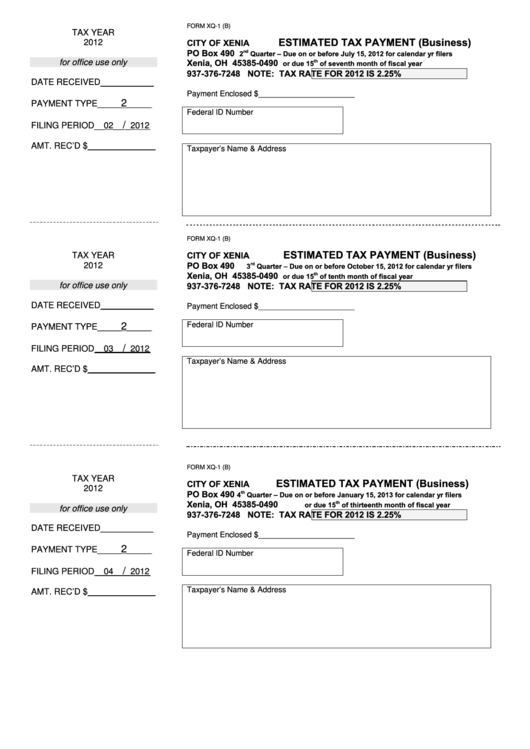

FORM XQ-1 (B)

TAX YEAR

ESTIMATED TAX PAYMENT (Business)

CITY OF XENIA

2012

PO Box 490

nd

2

Quarter – Due on or before July 15, 2012 for calendar yr filers

Xenia, OH 45385-0490

for office use only

th

or due 15

of seventh month of fiscal year

937-376-7248

NOTE: TAX RATE FOR 2012 IS 2.25%

DATE RECEIVED___________

Payment Enclosed $______________________

2

PAYMENT TYPE_____

_____

Federal ID Number

/

FILING PERIOD__02__

_2012

AMT. REC’D $______________

Taxpayer’s Name & Address

FORM XQ-1 (B)

ESTIMATED TAX PAYMENT (Business)

CITY OF XENIA

TAX YEAR

PO Box 490

rd

2012

3

Quarter – Due on or before October 15, 2012 for calendar yr filers

Xenia, OH 45385-0490

th

or due 15

of tenth month of fiscal year

937-376-7248

NOTE: TAX RATE FOR 2012 IS 2.25%

for office use only

DATE RECEIVED___________

Payment Enclosed $______________________

Federal ID Number

2

PAYMENT TYPE_____

_____

/

FILING PERIOD__03__

_2012

Taxpayer’s Name & Address

AMT. REC’D $______________

FORM XQ-1 (B)

TAX YEAR

ESTIMATED TAX PAYMENT (Business)

CITY OF XENIA

2012

PO Box 490

th

4

Quarter – Due on or before January 15, 2013 for calendar yr filers

Xenia, OH 45385-0490

th

or due 15

of thirteenth month of fiscal year

for office use only

937-376-7248

NOTE: TAX RATE FOR 2012 IS 2.25%

DATE RECEIVED___________

Payment Enclosed $______________________

2

PAYMENT TYPE_____

_____

Federal ID Number

/

FILING PERIOD__04__

_2012

Taxpayer’s Name & Address

AMT. REC’D $______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2