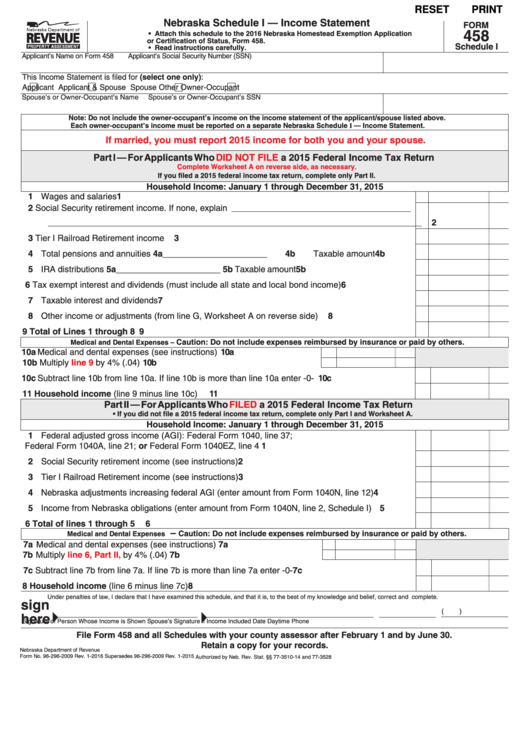

RESET

PRINT

Nebraska Schedule I — Income Statement

FORM

458

• Attach this schedule to the 2016 Nebraska Homestead Exemption Application

or Certification of Status, Form 458.

Schedule I

• Read instructions carefully.

Applicant’s Name on Form 458

Applicant’s Social Security Number (SSN)

This Income Statement is filed for (select one only):

Applicant

Applicant & Spouse

Spouse

Other Owner-Occupant

Spouse’s or Owner-Occupant’s Name

Spouse’s or Owner-Occupant’s SSN

Note:

Do not include the owner-occupant’s income on the income statement of the applicant/spouse listed above.

Each owner-occupant’s income must be reported on a separate Nebraska Schedule I — Income Statement.

If married, you must report 2015 income for both you and your spouse.

Part I — For Applicants Who

DID NOT FILE

a 2015 Federal Income Tax Return

Complete Worksheet A on reverse side, as necessary.

If you filed a 2015 federal income tax return, complete only Part II.

Household Income: January 1 through December 31, 2015

1 Wages and salaries . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Social Security retirement income. If none, explain

______________________________________________

2

________________________________________________________________________________________________

3 Tier I Railroad Retirement income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Total pensions and annuities 4a______________________

4b Taxable amount . . . . . . . . . . . 4b

5 IRA distributions

5a______________________

5b Taxable amount . . . . . . . . . . . 5b

6 Tax exempt interest and dividends (must include all state and local bond income) . . . . . . . . . . . . . .

6

7 Taxable interest and dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Other income or adjustments (from line G, Worksheet A on reverse side). . . . . . . . . . . . . . . . . . . . .

8

9 Total of Lines 1 through 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

Caution: Do not include expenses reimbursed by insurance or paid by others.

Medical and Dental Expenses –

10a Medical and dental expenses (see instructions) . . . . . . . . . . . . . . . . . . . . 10a

10b Multiply

line 9

by 4% (.04) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10b

10c Subtract line 10b from line 10a. If line 10b is more than line 10a enter -0- . . . . . . . . . . . . . . . . . . . . 10c

11 Household income (line 9 minus line 10c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

Part II — For Applicants Who

FILED

a 2015 Federal Income Tax Return

• If you did not file a 2015 federal income tax return, complete only Part I and Worksheet A.

Household Income: January 1 through December 31, 2015

1 Federal adjusted gross income (AGI): Federal Form 1040, line 37;

Federal Form 1040A, line 21; or Federal Form 1040EZ, line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Social Security retirement income (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Tier I Railroad Retirement income (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Nebraska adjustments increasing federal AGI (enter amount from Form 1040N, line 12) . . . . . . . . .

4

5 Income from Nebraska obligations (enter amount from Form 1040N, line 2, Schedule I) . . . . . . . . . .

5

6 Total of lines 1 through 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

–

Caution: Do not include expenses reimbursed by insurance or paid by others.

Medical and Dental Expenses

7a Medical and dental expenses (see instructions) . . . . . . . . . . . . . . . . . . . . . . 7a

7b Multiply

line 6, Part II,

by 4% (.04) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7b

7c Subtract line 7b from line 7a. If line 7b is more than line 7a enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . 7c

8 Household income (line 6 minus line 7c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

Under penalties of law, I declare that I have examined this schedule, and that it is, to the best of my knowledge and belief, correct and complete.

sign

(

)

here

Signature of Person Whose Income is Shown

Spouse’s Signature if Income Included

Date

Daytime Phone

File Form 458 and all Schedules with your county assessor after February 1 and by June 30.

Retain a copy for your records.

Nebraska Department of Revenue

Form No. 96-296-2009 Rev. 1-2016 Supersedes 96-296-2009 Rev. 1-2015

Authorized by Neb. Rev. Stat. §§ 77-3510-14 and 77-3528

1

1 2

2