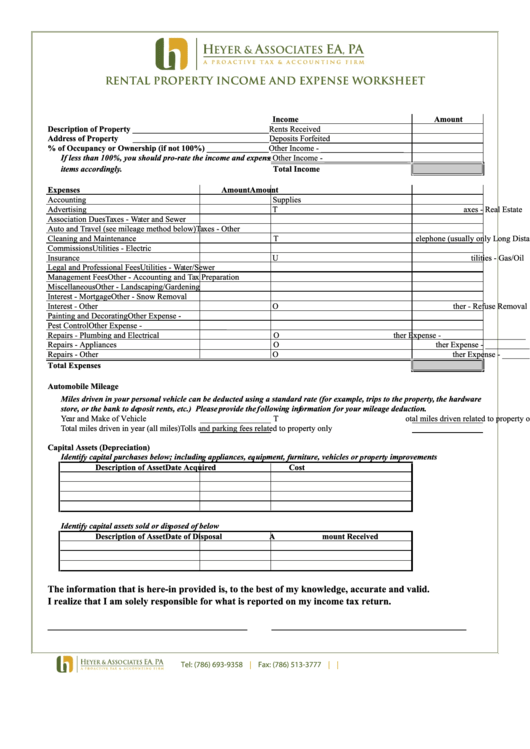

Rental Property Income And Expense Worksheet

ADVERTISEMENT

Rental Property Income and Expense worksheet

Income

Amount

Description of Property _________________________________ Rents Received

_________________________________ Deposits Forfeited

Address of Property

% of Occupancy or Ownership (if not 100%) _______________ Other Income - ____________________

If less than 100%, you should pro-rate the income and expenseOther Income - ____________________

items accordingly.

Total Income

Expenses

Amount

Amount

Accounting

Supplies

Advertising

Taxes - Real Estate

Association Dues

Taxes - Water and Sewer

Auto and Travel (see mileage method below)

Taxes - Other

Cleaning and Maintenance

Telephone (usually only Long Distance)

Commissions

Utilities - Electric

Insurance

Utilities - Gas/Oil

Legal and Professional Fees

Utilities - Water/Sewer

Management Fees

Other - Accounting and Tax Preparation

Miscellaneous

Other - Landscaping/Gardening

Interest - Mortgage

Other - Snow Removal

Interest - Other

Other - Refuse Removal

Painting and Decorating

Other Expense - ____________________

Pest Control

Other Expense - ____________________

Repairs - Plumbing and Electrical

Other Expense - ____________________

Repairs - Appliances

Other Expense - ____________________

Repairs - Other

Other Expense - ____________________

Total Expenses

Automobile Mileage

Miles driven in your personal vehicle can be deducted using a standard rate (for example, trips to the property, the hardware

store, or the bank to deposit rents, etc.) Please provide the following information for your mileage deduction.

Year and Make of Vehicle

Total miles driven related to property only

Total miles driven in year (all miles)

Tolls and parking fees related to property only

Capital Assets (Depreciation)

Identify capital purchases below; including appliances, equipment, furniture, vehicles or property improvements

Description of Asset

Date Acquired

Cost

Identify capital assets sold or disposed of below

Description of Asset

Date of Disposal

Amount Received

The information that is here-in provided is, to the best of my knowledge, accurate and valid.

I realize that I am solely responsible for what is reported on my income tax return.

_________________________________________

________________________________________

Tel: (786) 693-9358

|

Fax: (786) 513-3777

|

|

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1