Form Wv/mptac-1 - Manufacturing Property Tax Adjustment Credit

ADVERTISEMENT

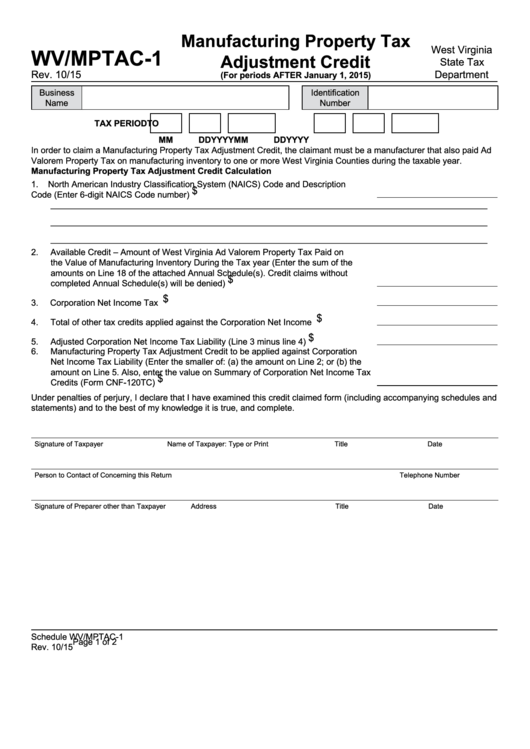

Manufacturing Property Tax

West Virginia

WV/MPTAC-1

Adjustment Credit

State Tax

Rev. 10/15

Department

(For periods AFTER January 1, 2015)

Business

Identification

Name

Number

TAx PERiod

To

MM

dd

YYYY

MM

dd

YYYY

In order to claim a Manufacturing Property Tax Adjustment Credit, the claimant must be a manufacturer that also paid Ad

Valorem Property Tax on manufacturing inventory to one or more West Virginia Counties during the taxable year.

Manufacturing Property Tax Adjustment Credit Calculation

1.

North American Industry Classification System (NAICS) Code and Description

$

Code (Enter 6-digit NAICS Code number)....................................................................

____________________________________________________________________________________________

____________________________________________________________________________________________

____________________________________________________________________________________________

2.

Available Credit – Amount of West Virginia Ad Valorem Property Tax Paid on

the Value of Manufacturing Inventory During the Tax year (Enter the sum of the

amounts on Line 18 of the attached Annual Schedule(s). Credit claims without

$

completed Annual Schedule(s) will be denied)............................................................

$

3.

Corporation Net Income Tax Liability............................................................................

$

4.

Total of other tax credits applied against the Corporation Net Income Tax..................

$

5.

Adjusted Corporation Net Income Tax Liability (Line 3 minus line 4)...........................

6.

Manufacturing Property Tax Adjustment Credit to be applied against Corporation

Net Income Tax Liability (Enter the smaller of: (a) the amount on Line 2; or (b) the

amount on Line 5. Also, enter the value on Summary of Corporation Net Income Tax

$

Credits (Form CNF-120TC).........................................................................................

Under penalties of perjury, I declare that I have examined this credit claimed form (including accompanying schedules and

statements) and to the best of my knowledge it is true, and complete.

Signature of Taxpayer

Name of Taxpayer: Type or Print

Title

Date

Person to Contact of Concerning this Return

Telephone Number

Signature of Preparer other than Taxpayer

Address

Title

Date

Schedule WV/MPTAC-1

Page 1 of 2

Rev. 10/15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2