Limited Liability Company (Llc) Cancellation Requirements - 2017, Form Llc-4/7 - Instructions For Completing The Certificate Of Cancellation - 2017

ADVERTISEMENT

Secretary of State

Business Programs Division

Business Entities, 1500 11th Street, Sacramento, CA 95814

Limited Liability Company (LLC)

Cancellation Requirements – What Form to File

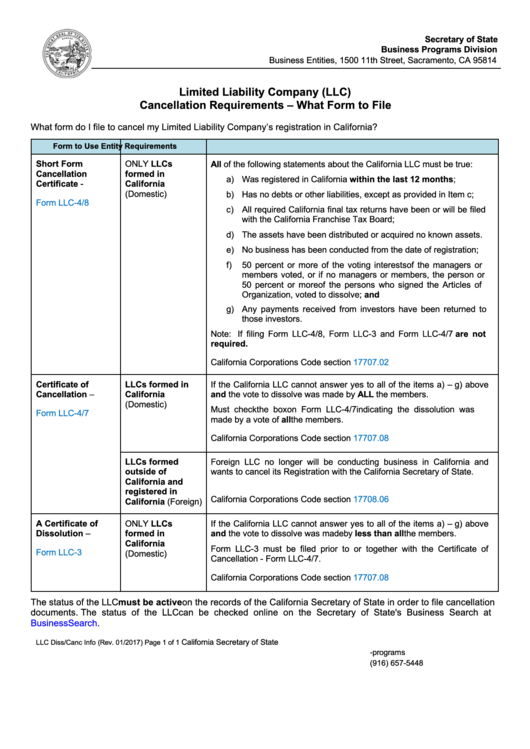

What form do I file to cancel my Limited Liability Company’s registration in California?

Form to Use

Entity

Requirements

Short Form

ONLY LLCs

All of the following statements about the California LLC must be true:

Cancellation

formed in

a) Was registered in California within the last 12 months;

Certificate -

California

(Domestic)

b) Has no debts or other liabilities, except as provided in Item c;

Form LLC-4/8

c) All required California final tax returns have been or will be filed

with the California Franchise Tax Board;

d) The assets have been distributed or acquired no known assets.

e) No business has been conducted from the date of registration;

f)

50 percent or more of the voting interests of the managers or

members voted, or if no managers or members, the person or

50 percent or more of the persons who signed the Articles of

Organization, voted to dissolve; and

g) Any payments received from investors have been returned to

those investors.

Note: If filing Form LLC-4/8, Form LLC-3 and Form LLC-4/7 are not

required.

California Corporations Code section

17707.02

Certificate of

LLCs formed in

If the California LLC cannot answer yes to all of the items a) – g) above

Cancellation –

California

and the vote to dissolve was made by ALL the members.

(Domestic)

Must check the box on Form LLC-4/7 indicating the dissolution was

Form LLC-4/7

made by a vote of all the members.

California Corporations Code section

17707.08

LLCs formed

Foreign LLC no longer will be conducting business in California and

outside of

wants to cancel its Registration with the California Secretary of State.

California and

registered in

California Corporations Code section

17708.06

California (Foreign)

A Certificate of

ONLY LLCs

If the California LLC cannot answer yes to all of the items a) – g) above

Dissolution –

formed in

and the vote to dissolve was made by less than all the members.

California

Form LLC-3 must be filed prior to or together with the Certificate of

Form LLC-3

(Domestic)

Cancellation - Form LLC-4/7.

California Corporations Code section

17707.08

The status of the LLC must be active on the records of the California Secretary of State in order to file cancellation

documents. The status of the LLC can be checked online on the Secretary of State's Business Search at

BusinessSearch.sos.ca.gov.

California Secretary of State

LLC Diss/Canc Info (Rev. 01/2017)

Page 1 of 1

(916) 657-5448

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3