Line-By-Line Instructions For Form Np, Net Profit License Tax Return

ADVERTISEMENT

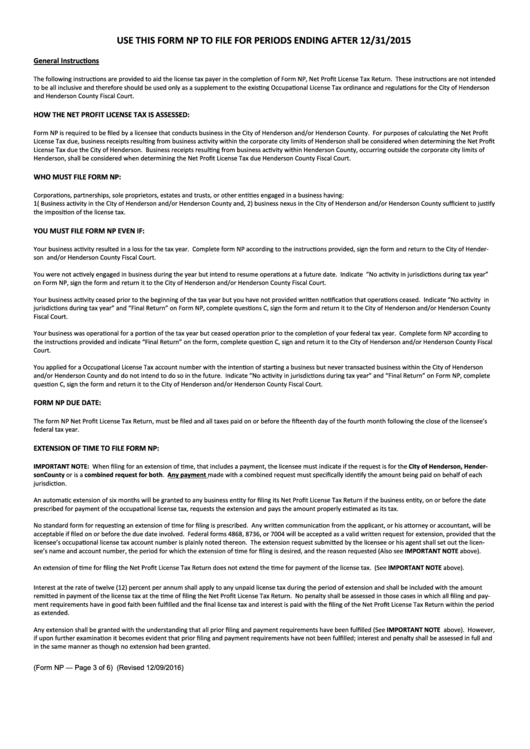

USE THIS FORM NP TO FILE FOR PERIODS ENDING AFTER 12/31/2015

General Instruc ons

The following instruc ons are provided to aid the license tax payer in the comple on of Form NP, Net Profit License Tax Return. These instruc ons are not intended

to be all inclusive and therefore should be used only as a supplement to the exis ng Occupa onal License Tax ordinance and regula ons for the City of Henderson

and Henderson County Fiscal Court.

HOW THE NET PROFIT LICENSE TAX IS ASSESSED:

Form NP is required to be filed by a licensee that conducts business in the City of Henderson and/or Henderson County. For purposes of calcula ng the Net Profit

License Tax due, business receipts resul ng from business ac vity within the corporate city limits of Henderson shall be considered when determining the Net Profit

License Tax due the City of Henderson. Business receipts resul ng from business ac vity within Henderson County, occurring outside the corporate city limits of

Henderson, shall be considered when determining the Net Profit License Tax due Henderson County Fiscal Court.

WHO MUST FILE FORM NP:

Corpora ons, partnerships, sole proprietors, estates and trusts, or other en

es engaged in a business having:

1( Business ac vity in the City of Henderson and/or Henderson County and, 2) business nexus in the City of Henderson and/or Henderson County sufficient to jus fy

the imposi on of the license tax.

YOU MUST FILE FORM NP EVEN IF:

Your business ac vity resulted in a loss for the tax year. Complete form NP according to the instruc ons provided, sign the form and return to the City of Hender-

son and/or Henderson County Fiscal Court.

You were not ac vely engaged in business during the year but intend to resume opera ons at a future date. Indicate “No ac vity in jurisdic ons during tax year”

on Form NP, sign the form and return it to the City of Henderson and/or Henderson County Fiscal Court.

Your business ac vity ceased prior to the beginning of the tax year but you have not provided wri en no fica on that opera ons ceased. Indicate “No ac vity in

jurisdic ons during tax year” and “Final Return” on Form NP, complete ques ons C, sign the form and return it to the City of Henderson and/or Henderson County

Fiscal Court.

Your business was opera onal for a por on of the tax year but ceased opera on prior to the comple on of your federal tax year. Complete form NP according to

the instruc ons provided and indicate “Final Return” on the form, complete ques on C, sign and return it to the City of Henderson and/or Henderson County Fiscal

Court.

You applied for a Occupa onal License Tax account number with the inten on of star ng a business but never transacted business within the City of Henderson

and/or Henderson County and do not intend to do so in the future. Indicate “No ac vity in jurisdic ons during tax year” and “Final Return” on Form NP, complete

ques on C, sign the form and return it to the City of Henderson and/or Henderson County Fiscal Court.

FORM NP DUE DATE:

The form NP Net Profit License Tax Return, must be filed and all taxes paid on or before the fi eenth day of the fourth month following the close of the licensee’s

federal tax year.

EXTENSION OF TIME TO FILE FORM NP:

IMPORTANT NOTE: When filing for an extension of me, that includes a payment, the licensee must indicate if the request is for the City of Henderson, Hender-

son County or is a combined request for both. Any payment made with a combined request must specifically iden fy the amount being paid on behalf of each

jurisdic on.

An automa c extension of six months will be granted to any business en ty for filing its Net Profit License Tax Return if the business en ty, on or before the date

prescribed for payment of the occupa onal license tax, requests the extension and pays the amount properly es mated as its tax.

No standard form for reques ng an extension of me for filing is prescribed. Any wri en communica on from the applicant, or his a orney or accountant, will be

acceptable if filed on or before the due date involved. Federal forms 4868, 8736, or 7004 will be accepted as a valid wri en request for extension, provided that the

licensee’s occupa onal license tax account number is plainly noted thereon. The extension request submi ed by the licensee or his agent shall set out the licen-

see’s name and account number, the period for which the extension of me for filing is desired, and the reason requested (Also see IMPORTANT NOTE above).

An extension of me for filing the Net Profit License Tax Return does not extend the me for payment of the license tax. (See IMPORTANT NOTE above).

Interest at the rate of twelve (12) percent per annum shall apply to any unpaid license tax during the period of extension and shall be included with the amount

remi ed in payment of the license tax at the me of filing the Net Profit License Tax Return. No penalty shall be assessed in those cases in which all filing and pay-

ment requirements have in good faith been fulfilled and the final license tax and interest is paid with the filing of the Net Profit License Tax Return within the period

as extended.

Any extension shall be granted with the understanding that all prior filing and payment requirements have been fulfilled (See IMPORTANT NOTE above). However,

if upon further examina on it becomes evident that prior filing and payment requirements have not been fulfilled; interest and penalty shall be assessed in full and

in the same manner as though no extension had been granted.

(Form NP — Page 3 of 6)

(Revised 12/09/2016)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4