Form Mi-8633 - Application To Participate In The Michigan E-File Program

ADVERTISEMENT

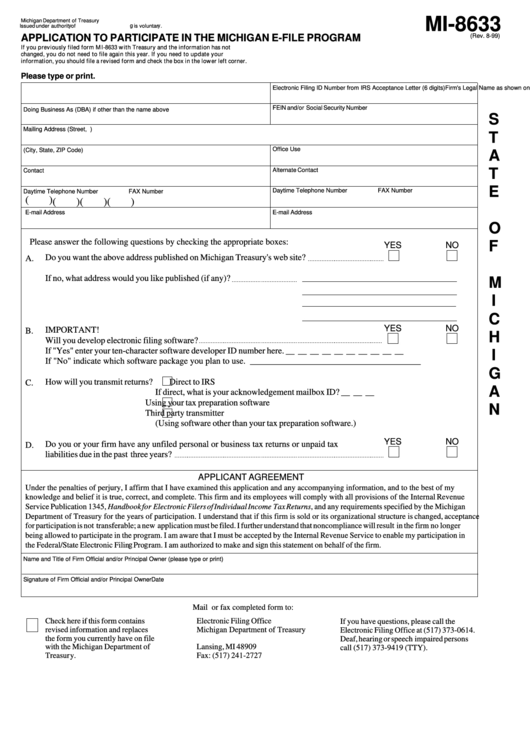

MI-8633

Michigan Department of Treasury

Issued under authority of P.A. 281 of 1967. Filing is voluntary.

(Rev. 8-99)

APPLICATION TO PARTICIPATE IN THE MICHIGAN E-FILE PROGRAM

If you previously filed form MI-8633 with Treasury and the information has not

changed, you do not need to file again this year. If you need to update your

information, you should file a revised form and check the box in the lower left corner.

Please type or print.

Firm's Legal Name as shown on the firm's tax return

Electronic Filing ID Number from IRS Acceptance Letter (6 digits)

FEIN and/or Social Security Number

Doing Business As (DBA) if other than the name above

S

Mailing Address (Street, P.O. Box)

T

Office Use

(City, State, ZIP Code)

A

Alternate Contact

T

Contact

E

Daytime Telephone Number

FAX Number

Daytime Telephone Number

FAX Number

(

)

(

)

(

)

(

)

E-mail Address

E-mail Address

O

Please answer the following questions by checking the appropriate boxes:

F

YES

NO

Do you want the above address published on Michigan Treasury's web site?

A.

If no, what address would you like published (if any)?

M

I

C

YES

NO

IMPORTANT!

B.

H

Will you develop electronic filing software?

If "Yes" enter your ten-character software developer ID number here. __ __ __ __ __ __ __ __ __ __

I

If "No" indicate which software package you plan to use. _______________________________________

G

How will you transmit returns?

Direct to IRS

C.

A

If direct, what is your acknowledgement mailbox ID? __ __ __

Using your tax preparation software

N

Third party transmitter

(Using software other than your tax preparation software.)

YES

NO

Do you or your firm have any unfiled personal or business tax returns or unpaid tax

D.

liabilities due in the past three years?

APPLICANT AGREEMENT

Under the penalties of perjury, I affirm that I have examined this application and any accompanying information, and to the best of my

knowledge and belief it is true, correct, and complete. This firm and its employees will comply with all provisions of the Internal Revenue

Service Publication 1345, Handbook for Electronic Filers of Individual Income Tax Returns, and any requirements specified by the Michigan

Department of Treasury for the years of participation. I understand that if this firm is sold or its organizational structure is changed, acceptance

for participation is not transferable; a new application must be filed. I further understand that noncompliance will result in the firm no longer

being allowed to participate in the program. I am aware that I must be accepted by the Internal Revenue Service to enable my participation in

the Federal/State Electronic Filing Program. I am authorized to make and sign this statement on behalf of the firm.

Name and Title of Firm Official and/or Principal Owner (please type or print)

Signature of Firm Official and/or Principal Owner

Date

Mail or fax completed form to:

Check here if this form contains

Electronic Filing Office

If you have questions, please call the

revised information and replaces

Michigan Department of Treasury

Electronic Filing Office at (517) 373-0614.

the form you currently have on file

P.O. Box 30058

Deaf, hearing or speech impaired persons

with the Michigan Department of

Lansing, MI 48909

call (517) 373-9419 (TTY).

Treasury.

Fax: (517) 241-2727

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1