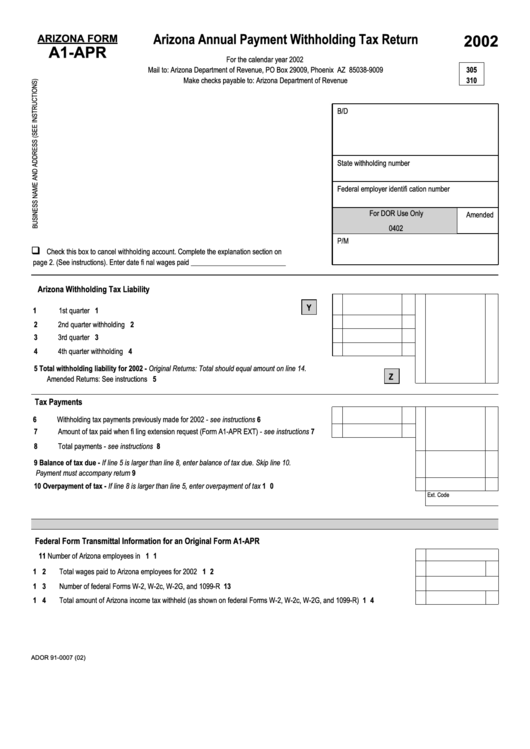

Arizona Form A1-Apr - Arizona Annual Payment Withholding Tax Return - 2002

ADVERTISEMENT

Arizona Annual Payment Withholding Tax Return

ARIZONA FORM

2002

A1-APR

For the calendar year 2002

Mail to: Arizona Department of Revenue, PO Box 29009, Phoenix AZ 85038-9009

305

Make checks payable to: Arizona Department of Revenue

310

B/D

State withholding number

Federal employer identifi cation number

For DOR Use Only

Amended

0402

P/M

Check this box to cancel withholding account. Complete the explanation section on

page 2. (See instructions). Enter date fi nal wages paid __________________________

Arizona Withholding Tax Liability

Y

1 1st quarter withholding......................................................................................................................

1

2 2nd quarter withholding ....................................................................................................................

2

3 3rd quarter withholding .....................................................................................................................

3

4 4th quarter withholding .....................................................................................................................

4

5 Total withholding liability for 2002 - Original Returns: Total should equal amount on line 14.

Z

Amended Returns: See instructions ................................................................................................................................................

5

Tax Payments

6 Withholding tax payments previously made for 2002 - see instructions ...........................................

6

7 Amount of tax paid when fi ling extension request (Form A1-APR EXT) - see instructions...............

7

8 Total payments - see instructions ....................................................................................................................................................

8

9 Balance of tax due - If line 5 is larger than line 8, enter balance of tax due. Skip line 10.

Payment must accompany return ....................................................................................................................................................

9

10 Overpayment of tax - If line 8 is larger than line 5, enter overpayment of tax ............................................................................... 10

Ext. Code

Federal Form Transmittal Information for an Original Form A1-APR

11 Number of Arizona employees in 2002............................................................................................................................................ 11

12 Total wages paid to Arizona employees for 2002 ............................................................................................................................ 12

13 Number of federal Forms W-2, W-2c, W-2G, and 1099-R submitted .............................................................................................. 13

14 Total amount of Arizona income tax withheld (as shown on federal Forms W-2, W-2c, W-2G, and 1099-R).................................. 14

ADOR 91-0007 (02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2