Line-by-line Instructions for Completing Withholding Deposit - Monthly

Due Date: Monthly deposits are due the 15th day of the month following the month the tax was withheld.

Line 1: Withholding This Period – Enter the total tax withheld for the period. If no tax has been withheld, enter

zero on this line, sign and return this form.

Line 2: Less Adjustments – Enter any adjustments for prior periods. Submit an explanation of the error and identify

the period when the error(s) was made. Enter your total New Jobs Credit, Supplement Jobs Credit, Housing Assistance,

or Accelerated Career Education Credit for the quarter here and identify the entry with the appropriate initials –

NJC, SJC, HAC, or ACE.

Line 3: Balance Due – Subtract line 2 from line 1.

Line 4: Penalty – If you owe penalty, compute the penalty on the amount on line 3 and enter on line 4.

Line 5: Interest – If you owe interest, compute the interest on the amount on line 3 and enter on line 5.

Line 6: Amount Due – Add lines 3, 4 and 5. Make check payable to TREASURER-STATE OF IOWA.

Penalty for Failure to Timely File a Return or Deposit: A penalty of 10% of the tax due will be added for failure

to timely file a return or deposit if at least 90% of the correct amount of tax is not paid by the due date. The penalty

can only be waived under limited circumstances.

Penalty for Failure to Timely Pay the Tax Due or Penalty for Audit Deficiency: A penalty of 5% of the tax due

will be added if the return/deposit is mailed timely but 90% of the correct amount of tax is not paid by the due date.

The penalty can only be waived under limited circumstances.

If both penalties apply, only the failure to file penalty is charged.

Interest: Taxes payable during calendar year 2003 are subject to interest at a rate of 0.6% per month which

accrues on unpaid tax from the due date of the deposit or return. Any fraction of a month is considered a whole

month for purposes of computing interest. The interest rate varies on an annual basis.

Signature of Withholding Agent: The person signing the return must be the individual responsible for actually

withholding and remitting withholding taxes and can be held personally liable for unpaid taxes. The return must be

signed and dated to be complete.

Mail To: Iowa Department of Revenue and Finance, PO Box 10411, Des Moines IA 50306-0411

Withholding Tax Guide: The current Iowa Withholding Tax Guide, dated January 1, 1998, and additional information

may be obtained by...

u Web Site:

u Tax Fax: 1-800-572-3943 to have forms faxed to you

u Recorded Information: 1-800-351-4658 (Iowa only) or 515/281-4170

u Telephone: 1-800-532-1531 (Iowa only) or 515/281-7239 to order forms and publications.

u Taxpayer Services to talk to a tax specialist: 1-800-367-3388 (Iowa, Omaha, Rock Island/Moline) or

515/281-3114 from out of state or Des Moines. Monday, Tuesday, Thursday: 8 a.m. - 4 p.m.;

Wednesday, Friday: 9 a.m. - 4 p.m. u E-mail: idrf@idrf.state.ia.us

DETACH HERE

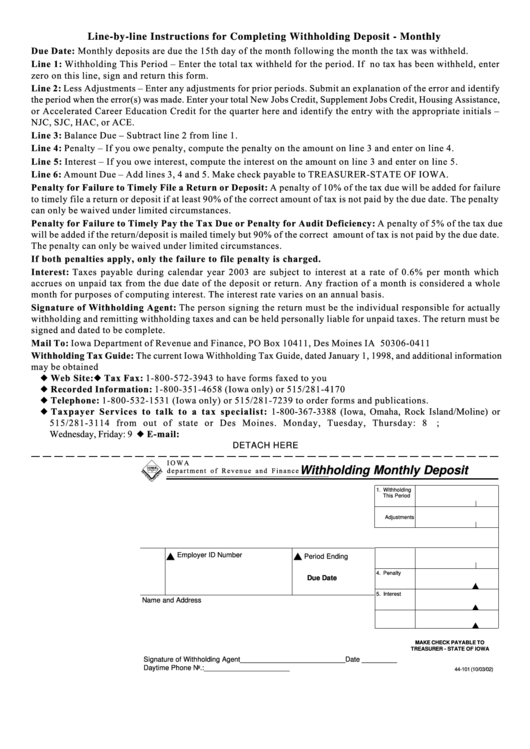

I O WA

Withholding Monthly Deposit

d e p a r t m e n t o f R e v e n u e a n d F i n a n c e

1. Withholding

This Period

2. Less Credits/

Adjustments

s

s

3. Balance Due

Employer ID Number

Period Ending

4. Penalty

Due Date

s

5. Interest

Name and Address

s

6. Amount Due

s

MAKE CHECK PAYABLE TO

TREASURER - STATE OF IOWA

Signature of Withholding Agent ___________________________ Date _________

Daytime Phone No.: ______________________

44-101 (10/03/02)

1

1 2

2