Form F - Iowa Franchise Tax Payment Voucher For Financial Institutions - 2002

ADVERTISEMENT

IOWA

Iowa Franchise Tax Payment Voucher

department of Revenue and Finance

INSTRUCTIONS

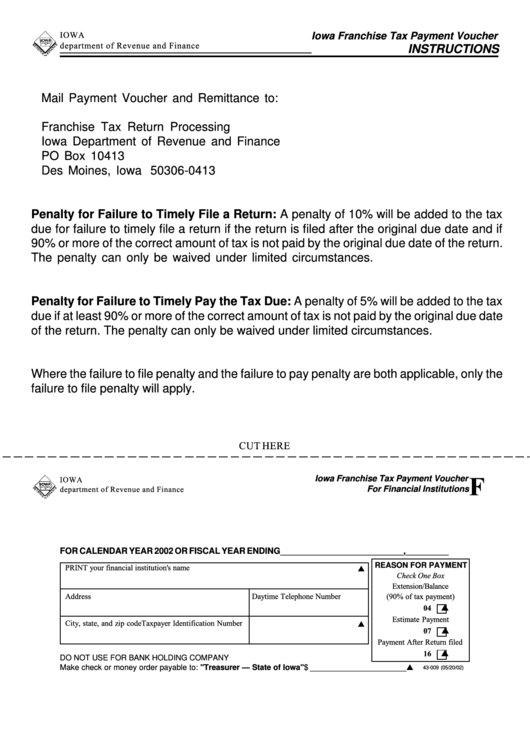

Mail Payment Voucher and Remittance to:

Franchise Tax Return Processing

Iowa Department of Revenue and Finance

PO Box 10413

Des Moines, Iowa 50306-0413

Penalty for Failure to Timely File a Return: A penalty of 10% will be added to the tax

due for failure to timely file a return if the return is filed after the original due date and if

90% or more of the correct amount of tax is not paid by the original due date of the return.

The penalty can only be waived under limited circumstances.

Penalty for Failure to Timely Pay the Tax Due: A penalty of 5% will be added to the tax

due if at least 90% or more of the correct amount of tax is not paid by the original due date

of the return. The penalty can only be waived under limited circumstances.

Where the failure to file penalty and the failure to pay penalty are both applicable, only the

failure to file penalty will apply.

CUT HERE

F

Iowa Franchise Tax Payment Voucher

IOWA

department of Revenue and Finance

For Financial Institutions

FOR CALENDAR YEAR 2002 OR FISCAL YEAR ENDING __________________________ , _________

REASON FOR PAYMENT

PRINT your financial institution's name

Check One Box

Extension/Balance

Address

Daytime Telephone Number

(90% of tax payment)

04

Estimate Payment

City, state, and zip code

Taxpayer Identification Number

07

Payment After Return filed

16

DO NOT USE FOR BANK HOLDING COMPANY

Make check or money order payable to: "Treasurer — State of Iowa" $ ______________________

43-009 (05/20/02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1