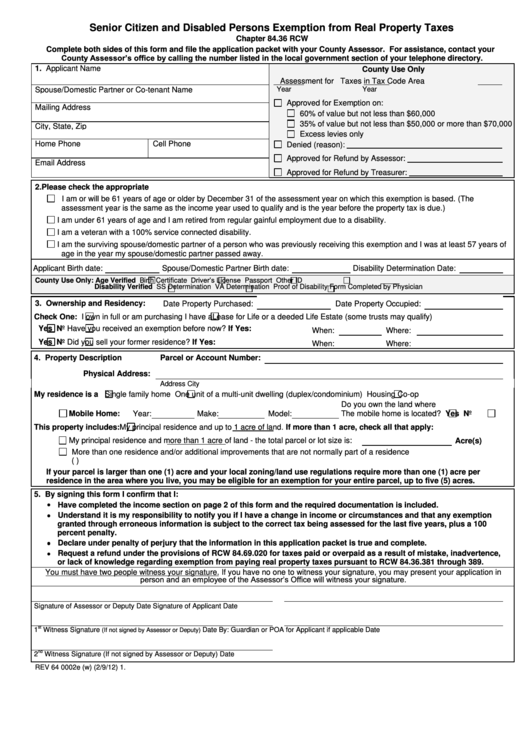

Senior Citizen and Disabled Persons Exemption from Real Property Taxes

Chapter 84.36 RCW

Complete both sides of this form and file the application packet with your County Assessor. For assistance, contact your

County Assessor’s office by calling the number listed in the local government section of your telephone directory.

1. Applicant Name

County Use Only

Assessment for

Taxes in Tax Code Area

Spouse/Domestic Partner or Co-tenant Name

Year

Year

Approved for Exemption on:

Mailing Address

60% of value but not less than $60,000

35% of value but not less than $50,000 or more than $70,000

City, State, Zip

Excess levies only

Home Phone

Cell Phone

Denied (reason):

Approved for Refund by Assessor:

Email Address

Email

Address

Approved for Refund by Treasurer:

2. Please check the appropriate box. Proof of age or disability is required.

I am or will be 61 years of age or older by December 31 of the assessment year on which this exemption is based. (The

assessment year is the same as the income year used to qualify and is the year before the property tax is due.)

I am under 61 years of age and I am retired from regular gainful employment due to a disability.

I am a veteran with a 100% service connected disability.

I am the surviving spouse/domestic partner of a person who was previously receiving this exemption and I was at least 57 years of

age in the year my spouse/domestic partner passed away.

Applicant Birth date:

Spouse/Domestic Partner Birth date:

Disability Determination Date:

Driver’s License

County Use Only: Age Verified

Birth Certificate

Passport

Other ID

Disability Verified

SS Determination

VA Determination

Proof of Disability Form Completed by Physician

3. Ownership and Residency:

Date Property Purchased:

Date Property Occupied:

Check One:

I own in full or am purchasing

I have a Lease for Life or a deeded Life Estate (some trusts may qualify)

Yes

No Have you received an exemption before now? If Yes:

When:

Where:

Yes

No Did you sell your former residence?

If Yes:

When:

Where:

4. Property Description

Parcel or Account Number:

Physical Address:

Address

City

My residence is a

Single family home

One unit of a multi-unit dwelling (duplex/condominium)

Housing Co-op

Do you own the land where

Mobile Home:

The mobile home is located?

Yes

No

Year:

Make:

Model:

This property includes:

My principal residence and up to 1 acre of land. If more than 1 acre, check all that apply:

My principal residence and more than 1 acre of land - the total parcel or lot size is:

Acre(s)

More than one residence and/or additional improvements that are not normally part of a residence

(i.e. commercial buildings or other improvements not typically part of a residential parcel)

If your parcel is larger than one (1) acre and your local zoning/land use regulations require more than one (1) acre per

residence in the area where you live, you may be eligible for an exemption for your entire parcel, up to five (5) acres.

5. By signing this form I confirm that I:

Have completed the income section on page 2 of this form and the required documentation is included.

Understand it is my responsibility to notify you if I have a change in income or circumstances and that any exemption

granted through erroneous information is subject to the correct tax being assessed for the last five years, plus a 100

percent penalty.

Declare under penalty of perjury that the information in this application packet is true and complete.

Request a refund under the provisions of RCW 84.69.020 for taxes paid or overpaid as a result of mistake, inadvertence,

or lack of knowledge regarding exemption from paying real property taxes pursuant to RCW 84.36.381 through 389.

You must have two people witness your signature. If you have no one to witness your signature, you may present your application in

person and an employee of the Assessor’s Office will witness your signature.

Signature of Assessor or Deputy

Date

Signature of Applicant

Date

st

1

Witness Signature

Date

By: Guardian or POA for Applicant if applicable

Date

(If not signed by Assessor or Deputy)

nd

2

Witness Signature (If not signed by Assessor or Deputy)

Date

REV 64 0002e (w) (2/9/12)

1.

1

1