Request For Sales And Use Tax Exemption - Virginia Department Of Taxation

ADVERTISEMENT

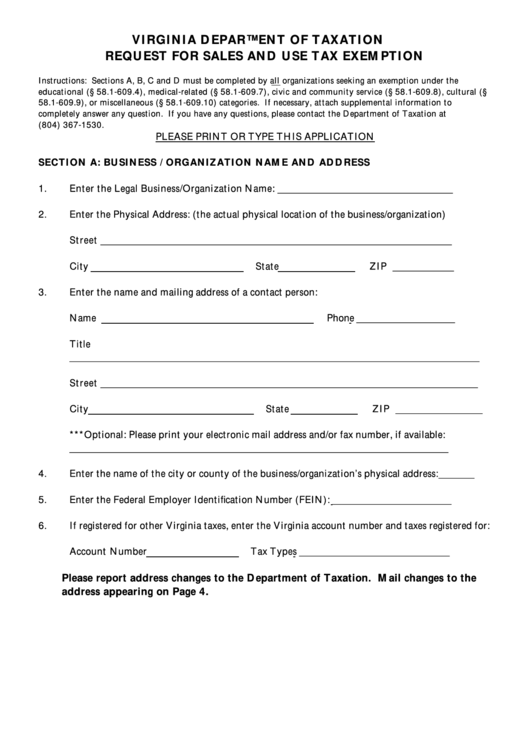

VIRGINIA DEPARTMENT OF TAXATION

REQUEST FOR SALES AND USE TAX EXEMPTION

Instructions: Sections A, B, C and D must be completed by all organizations seeking an exemption under the

educational (§ 58.1-609.4), medical-related (§ 58.1-609.7), civic and community service (§ 58.1-609.8), cultural (§

58.1-609.9), or miscellaneous (§ 58.1-609.10) categories. If necessary, attach supplemental information to

completely answer any question. If you have any questions, please contact the Department of Taxation at

(804) 367-1530.

PLEASE PRINT OR TYPE THIS APPLICATION

SECTION A: BUSINESS / ORGANIZATION NAME AND ADDRESS

1.

Enter the Legal Business/Organization Name: ___________________________________

2.

Enter the Physical Address: (the actual physical location of the business/organization)

Street ____________________________________________________________________

City

State

ZIP ____________

3.

Enter the name and mailing address of a contact person:

Name

Phone ___________________

Title

_______________________________________________________________________________

Street _________________________________________________________________________

City

State

ZIP _________________

***Optional: Please print your electronic mail address and/or fax number, if available:

_________________________________________________________________________

4.

Enter the name of the city or county of the business/organization’s physical address:_______

5.

Enter the Federal Employer Identification Number (FEIN): _______________________

6.

If registered for other Virginia taxes, enter the Virginia account number and taxes registered for:

Account Number

Tax Types _____________________________

Please report address changes to the Department of Taxation. Mail changes to the

address appearing on Page 4.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5