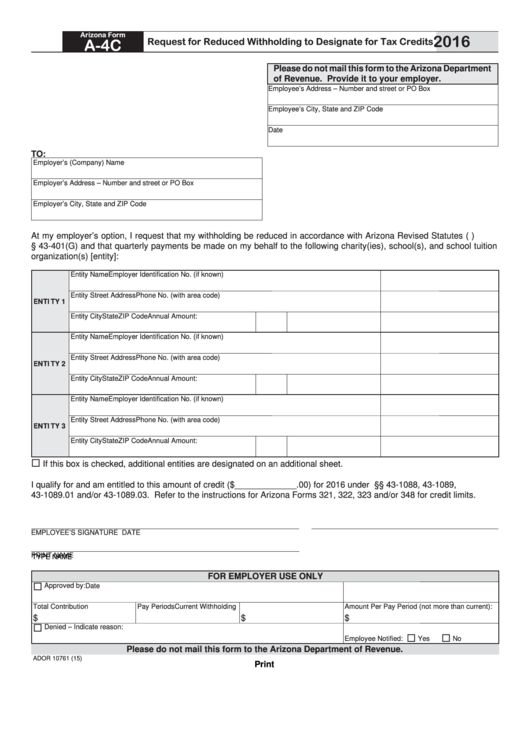

Arizona Form

2016

A-4C

Request for Reduced Withholding to Designate for Tax Credits

Please do not mail this form to the Arizona Department

of Revenue. Provide it to your employer.

Employee’s Address – Number and street or PO Box

Employee’s City, State and ZIP Code

Date

TO:

Employer’s (Company) Name

Employer’s Address – Number and street or PO Box

Employer’s City, State and ZIP Code

At my employer’s option, I request that my withholding be reduced in accordance with Arizona Revised Statutes (A.R.S.)

§ 43-401(G) and that quarterly payments be made on my behalf to the following charity(ies), school(s), and school tuition

organization(s) [entity]:

Entity Name

Employer Identification No. (if known)

Entity Street Address

Phone No. (with area code)

ENTITY 1

Entity City

State

ZIP Code

Annual Amount:

Entity Name

Employer Identification No. (if known)

Entity Street Address

Phone No. (with area code)

ENTITY 2

Entity City

State

ZIP Code

Annual Amount:

Entity Name

Employer Identification No. (if known)

Entity Street Address

Phone No. (with area code)

ENTITY 3

Entity City

State

ZIP Code

Annual Amount:

If this box is checked, additional entities are designated on an additional sheet.

I qualify for and am entitled to this amount of credit ($_____________.00) for 2016 under A.R.S. §§ 43-1088, 43-1089,

43-1089.01 and/or 43-1089.03. Refer to the instructions for Arizona Forms 321, 322, 323 and/or 348 for credit limits.

EMPLOYEE’S SIGNATURE

DATE

PRINT NAME

TYPE NAME

FOR EMPLOYER USE ONLY

Approved by:

Date

Total Contribution

Pay Periods

Current Withholding

Amount Per Pay Period (not more than current):

$

$

$

Denied – Indicate reason:

Employee Notified:

Yes

No

Please do not mail this form to the Arizona Department of Revenue.

ADOR 10761 (15)

Print

1

1