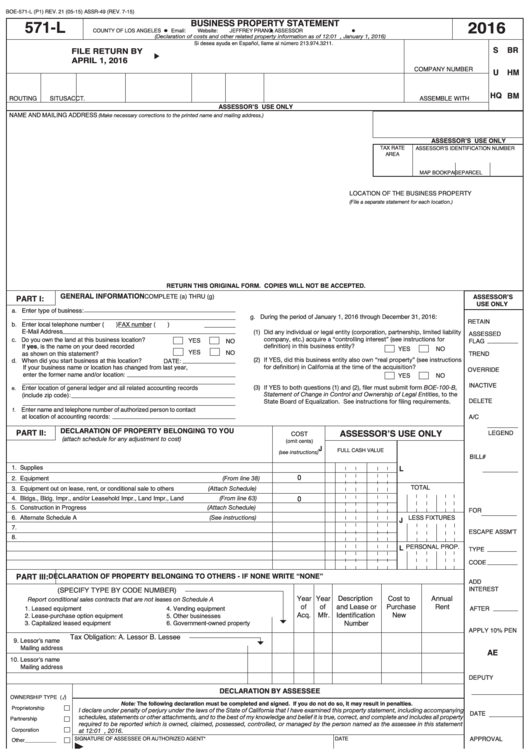

BOE-571-L (P1) REV. 21 (05-15) ASSR-49 (REV. 7-15)

571-L

2016

BUSINESS PROPERTY STATEMENT

COUNTY OF LOS ANGELES

Email: businesspp@assessor.lacounty.gov

Website: assessor.lacounty.gov

JEFFREY PRANG, ASSESSOR

(Declaration of costs and other related property information as of 12:01 A.M., January 1, 2016)

Si desea ayuda en Español, llame al número 213.974.3211.

S

BR

FILE RETURN BY

APRIL 1, 2016

COMPANY NUMBER

U

HM

HQ

BM

ROUTING

SITUS

ACCT. FORM

AUDIT

P.C.

B.C.C.

ASSEMBLE WITH

ASSESSOR’S USE ONLY

NAME AND MAILING ADDRESS

(Make necessary corrections to the printed name and mailing address.)

ASSESSOR’S USE ONLY

TAX RATE

ASSESSOR’S IDENTIFICATION NUMBER

AREA

MAP BOOK

PAGE

PARCEL

LOCATION OF THE BUSINESS PROPERTY

(File a separate statement for each location.)

RETURN THIS ORIGINAL FORM. COPIES WILL NOT BE ACCEPTED.

GENERAL INFORMATION

COMPLETE (a) THRU (g)

ASSESSOR’S

PART I:

USE ONLY

a. Enter type of business:

g. During the period of January 1, 2016 through December 31, 2016:

RETAIN

b. Enter local telephone number (

)

FAX number (

)

E-Mail Address

(1)

Did any individual or legal entity (corporation, partnership, limited liability

ASSESSED

company, etc.) acquire a “controlling interest” (see instructions for

c. Do you own the land at this business location?

YES

NO

FLAG

If yes, is the name on your deed recorded

definition) in this business entity?

YES

NO

YES

NO

as shown on this statement?

TREND

(2)

If YES, did this business entity also own “real property” (see instructions

d. When did you start business at this location?

DATE:

for definition) in California at the time of the acquisition?

If your business name or location has changed from last year,

OVERRIDE

enter the former name and/or location:

YES

NO

INACTIVE

(3)

If YES to both questions (1) and (2), filer must submit form BOE-100-B,

Enter location of general ledger and all related accounting records

e.

Statement of Change in Control and Ownership of Legal Entities, to the

(include zip code):

DELETE

State Board of Equalization. See instructions for filing requirements.

Enter name and telephone number of authorized person to contact

f.

at location of accounting records:

A/C

DECLARATION OF PROPERTY BELONGING TO YOU

ASSESSOR’S USE ONLY

PART II:

LEGEND

COST

(attach schedule for any adjustment to cost)

(omit cents)

J

FULL CASH VALUE

(see instructions)

BILL#

1. Supplies

L

2. Equipment

(From line 38)

0

TOTAL F.C.V.

3. Equipment out on lease, rent, or conditional sale to others

(Attach Schedule)

4. Bldgs., Bldg. Impr., and/or Leasehold Impr., Land Impr., Land

(From line 63)

0

5. Construction in Progress

(Attach Schedule)

FOR

6. Alternate Schedule A

(See instructions)

LESS FIXTURES

J

7.

ESCAPE ASSM’T

8.

PERSONAL PROP.

L

TYPE

CODE

PART III:

DECLARATION OF PROPERTY BELONGING TO OTHERS - IF NONE WRITE “NONE”

ADD

INTEREST

(SPECIFY TYPE BY CODE NUMBER)

Description

Year

Year

Cost to

Annual

Report conditional sales contracts that are not leases on Schedule A

and Lease or

Purchase

of

of

Rent

1. Leased equipment

4. Vending equipment

AFTER

Identification

New

Acq.

Mfr.

2. Lease-purchase option equipment

5. Other businesses

Number

3. Capitalized leased equipment

6. Government-owned property

APPLY 10% PEN

Tax Obligation: A. Lessor B. Lessee

9. Lessor’s name

Mailing address

AE

10. Lessor’s name

Mailing address

DEPUTY

DECLARATION BY ASSESSEE

OWNERSHIP TYPE ( )

Note: The following declaration must be completed and signed. If you do not do so, it may result in penalties.

Proprietorship

I declare under penalty of perjury under the laws of the State of California that I have examined this property statement, including accompanying

DATE

schedules, statements or other attachments, and to the best of my knowledge and belief it is true, correct, and complete and includes all property

Partnership

required to be reported which is owned, claimed, possessed, controlled, or managed by the person named as the assessee in this statement

Corporation

at 12:01 a.m. on January 1, 2016.

APPROVAL

SIGNATURE OF ASSESSEE OR AUTHORIZED AGENT*

DATE

Other

_____________

BUSINESS

NAME OF ASSESSEE OR AUTHORIZED AGENT* (typed or printed)

TITLE

DESCRIPTION

( )

FEDERAL EMPLOYER ID NUMBER

NAME OF LEGAL ENTITY

Retail

other than DBA) (typed or printed)

(

Wholesale

TITLE

USER

PREPARER’S NAME AND ADDRESS (typed or printed)

TELEPHONE NUMBER

YR AE

Manufacturer

CODE

(

)

Service/Professional

*Agent: see Declaration by Assessee section of instructions (back) (P6).

THIS STATEMENT SUBJECT TO AUDIT

INFORMATION PROVIDED ON A PROPERTY STATEMENT MAY BE SHARED WITH THE STATE BOARD OF EQUALIZATION

1

1 2

2