Information Form - Iowa Department Of Revenue And Finance

ADVERTISEMENT

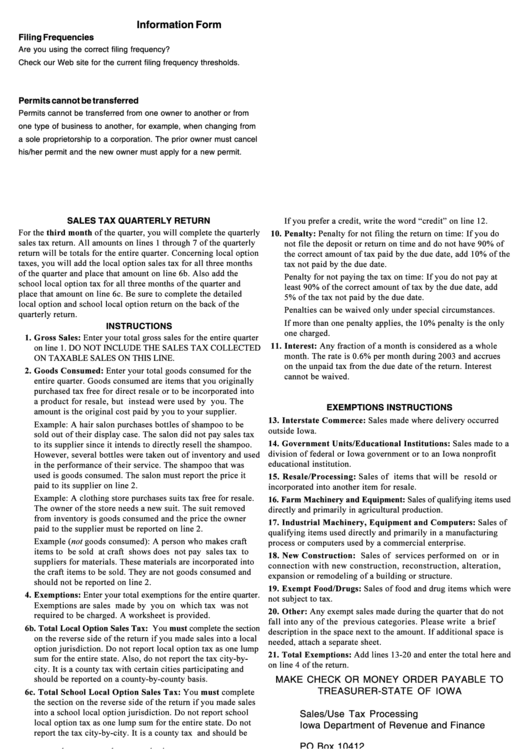

Information Form

Filing Frequencies

Are you using the correct filing frequency?

Check our Web site for the current filing frequency thresholds.

Permits cannot be transferred

Permits cannot be transferred from one owner to another or from

one type of business to another, for example, when changing from

a sole proprietorship to a corporation. The prior owner must cancel

his/her permit and the new owner must apply for a new permit.

SALES TAX QUARTERLY RETURN

third month

10. Penalty:

INSTRUCTIONS

1. Gross Sales:

11. Interest:

2. Goods Consumed:

EXEMPTIONS INSTRUCTIONS

13. Interstate Commerce:

14. Government Units/Educational Institutions:

15. Resale/Processing:

16. Farm Machinery and Equipment:

17. Industrial Machinery, Equipment and Computers:

not

18. New Construction:

19. Exempt Food/Drugs:

4. Exemptions:

20. Other:

6b. Total Local Option Sales Tax:

must

21. Total Exemptions:

MAKE CHECK OR MONEY ORDER PAYABLE TO

TREASURER-STATE OF IOWA

6c. Total School Local Option Sales Tax:

must

Sales/Use Tax Processing

Iowa Department of Revenue and Finance

PO Box 10412

Des Moines IA 50306-0412

8. Deposits and Overpayment Credits:

QUESTIONS?

Check out our Web site at

or call Taxpayer Services at

9. Balance:

1-800-367-3388

(Iowa, Omaha, Rock Island/Moline)

or 515/281-3114

(Des Moines, out-of-state)

E-mail: idrf@idrf.state.ia.us

31-089 rf04c 10/02

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2