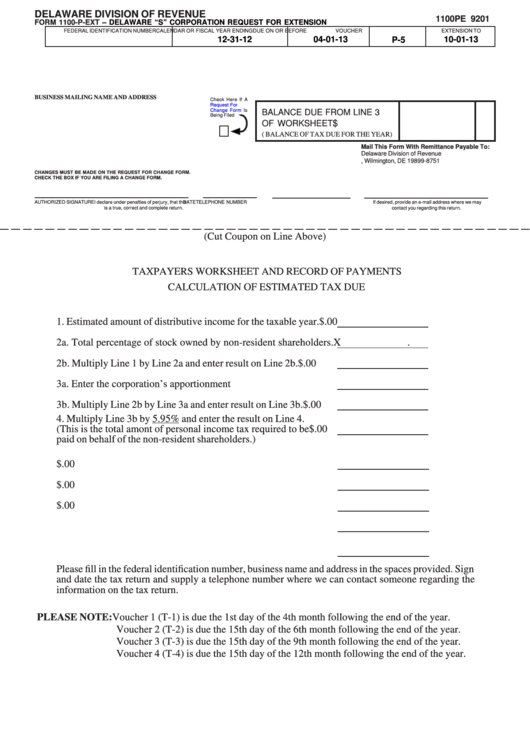

DELAWARE DIVISION OF REVENUE

1100PE 9201

FORM 1100-P-EXT

– DELAWARE “S” CORPORATION REQUEST FOR EXTENSION

FEDERAL IDENTIFICATION NUMBER

CALENDAR OR FISCAL YEAR ENDING

DUE ON OR BE FORE

VOUCHER

EXTENSION TO

0-000000000-000

12-31-12

04-01-13

10-01-13

P-5

Reset

00932505000000000000012311204011300000000000000000000

Print Form

BUSINESS MAILING NAME AND ADDRESS

Check Here If A

Request For

Change Form

Is

BALANCE DUE FROM LINE 3

Being Filed

$

0 0

OF WORKSHEET

( BALANCE OF TAX DUE FOR THE YEAR)

Mail This Form With Remittance Payable To:

Delaware Division of Revenue

P.O. Box 8751, Wilmington, DE 19899-8751

CHANGES MUST BE MADE ON THE REQUEST FOR CHANGE FORM.

CHECK THE BOX IF YOU ARE FILING A CHANGE FORM.

AUTHORIZED SIGNATURE I declare under penalties of perjury, that this

DATE

TELEPHONE NUMBER

If desired, provide an e-mail address where we may

is a true, correct and complete return.

contact you regarding this return.

(Cut Coupon on Line Above)

TAXPAYERS WORKSHEET AND RECORD OF PAYMENTS

CALCULATION OF ESTIMATED TAX DUE

1. Estimated amount of distributive income for the taxable year.

$

.00

2a. Total percentage of stock owned by non-resident shareholders. X

.

2b. Multiply Line 1 by Line 2a and enter result on Line 2b.

$

.00

3a. Enter the corporation’s apportionment percentage.

X

.

3b. Multiply Line 2b by Line 3a and enter result on Line 3b.

$

.00

4. Multiply Line 3b by 5.95% and enter the result on Line 4.

(This is the total amont of personal income tax required to be

$

.00

paid on behalf of the non-resident shareholders.)

5. Actual tax liability for the year.

$

.00

6. Estimated tax paid.

$

.00

7. Amount Due with Extension.

$

.00

8. Check Number.

9. Date Paid.

Please fill in the federal identification number, business name and address in the spaces provided. Sign

and date the tax return and supply a telephone number where we can contact someone regarding the

information on the tax return.

PLEASE NOTE: Voucher 1 (T-1) is due the 1st day of the 4th month following the end of the year.

Voucher 2 (T-2) is due the 15th day of the 6th month following the end of the year.

Voucher 3 (T-3) is due the 15th day of the 9th month following the end of the year.

Voucher 4 (T-4) is due the 15th day of the 12th month following the end of the year.

1

1