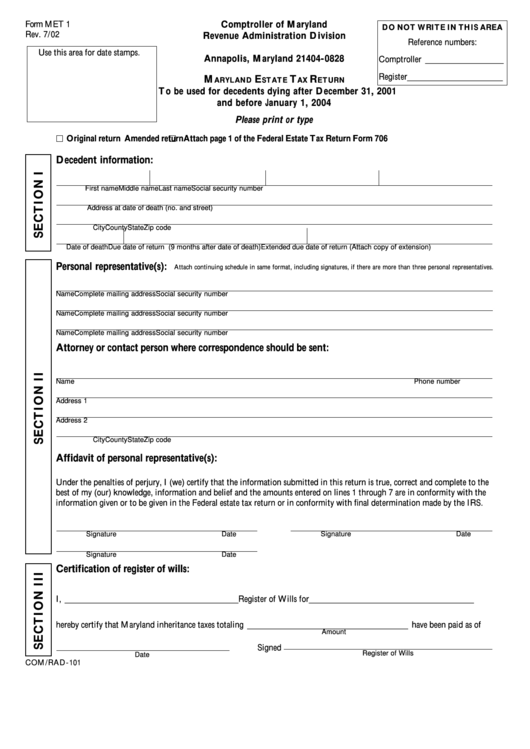

Form MET 1

Comptroller of Maryland

DO NOT WRITE IN THIS AREA

Rev. 7/02

Revenue Administration Division

Reference numbers:

P.O. Box 828

Use this area for date stamps.

Annapolis, Maryland 21404-0828

Comptroller __________________

Register ______________________

M

E

T

R

ARYLAND

STATE

AX

ETURN

To be used for decedents dying after December 31, 2001

and before January 1, 2004

Please print or type

Original return

Amended return

Attach page 1 of the Federal Estate Tax Return Form 706

Decedent information:

First name

Middle name

Last name

Social security number

Address at date of death (no. and street)

City

County

State

Zip code

Date of death

Due date of return (9 months after date of death)

Extended due date of return (Attach copy of extension)

Personal representative(s):

Attach continuing schedule in same format, including signatures, if there are more than three personal representatives.

Name

Complete mailing address

Social security number

Name

Complete mailing address

Social security number

Name

Complete mailing address

Social security number

Attorney or contact person where correspondence should be sent:

Name

Phone number

Address 1

Address 2

City

County

State

Zip code

Affidavit of personal representative(s):

Under the penalties of perjury, I (we) certify that the information submitted in this return is true, correct and complete to the

best of my (our) knowledge, information and belief and the amounts entered on lines 1 through 7 are in conformity with the

information given or to be given in the Federal estate tax return or in conformity with final determination made by the IRS.

Signature

Date

Signature

Date

Signature

Date

Certification of register of wills:

I, ________________________________________ Register of Wills for ______________________________________

hereby certify that Maryland inheritance taxes totaling _____________________________________ have been paid as of

Amount

Signed

Register of Wills

Date

COM/RAD-101

1

1 2

2 3

3 4

4