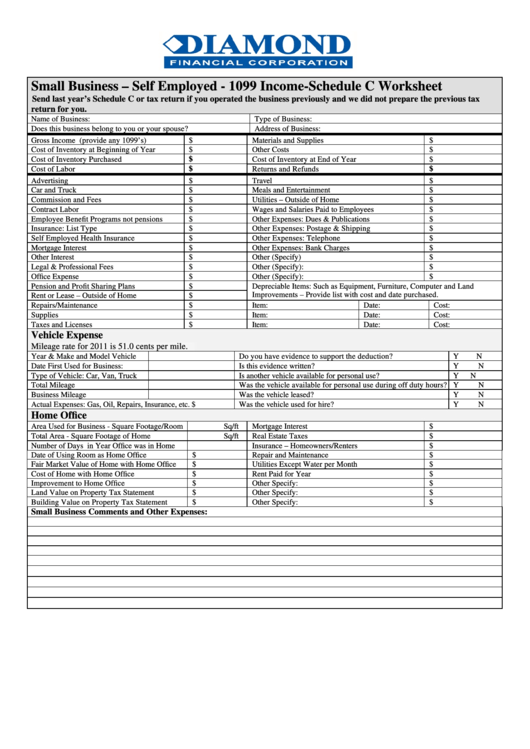

Small Business – Self Employed - 1099 Income-Schedule C Worksheet

Send last year’s Schedule C or tax return if you operated the business previously and we did not prepare the previous tax

return for you.

Name of Business:

Type of Business:

Does this business belong to you or your spouse?

Address of Business:

Gross Income (provide any 1099’s)

$

Materials and Supplies

$

Cost of Inventory at Beginning of Year

$

Other Costs

$

Cost of Inventory Purchased

Cost of Inventory at End of Year

$

$

Cost of Labor

Returns and Refunds

$

$

Advertising

$

Travel

$

Car and Truck

$

Meals and Entertainment

$

Commission and Fees

$

Utilities – Outside of Home

$

Contract Labor

$

Wages and Salaries Paid to Employees

$

Employee Benefit Programs not pensions

$

Other Expenses: Dues & Publications

$

Insurance: List Type

$

Other Expenses: Postage & Shipping

$

Self Employed Health Insurance

$

Other Expenses: Telephone

$

Mortgage Interest

$

Other Expenses: Bank Charges

$

Other Interest

$

Other (Specify)

$

Legal & Professional Fees

$

Other (Specify):

$

Office Expense

$

Other (Specify):

$

Pension and Profit Sharing Plans

$

Depreciable Items: Such as Equipment, Furniture, Computer and Land

Improvements – Provide list with cost and date purchased.

Rent or Lease – Outside of Home

$

Repairs/Maintenance

$

Item:

Date:

Cost:

Supplies

$

Item:

Date:

Cost:

Taxes and Licenses

$

Item:

Date:

Cost:

Vehicle Expense

Mileage rate for 2011 is 51.0 cents per mile.

Year & Make and Model Vehicle

Do you have evidence to support the deduction?

Y

N

Date First Used for Business:

Is this evidence written?

Y

N

Type of Vehicle: Car, Van, Truck

Is another vehicle available for personal use?

Y

N

Total Mileage

Was the vehicle available for personal use during off duty hours?

Y

N

Business Mileage

Was the vehicle leased?

Y

N

Actual Expenses: Gas, Oil, Repairs, Insurance, etc. $

Was the vehicle used for hire?

Y

N

Home Office

Area Used for Business - Square Footage/Room

Sq/ft

Mortgage Interest

$

Total Area - Square Footage of Home

Sq/ft

Real Estate Taxes

$

Number of Days in Year Office was in Home

Insurance – Homeowners/Renters

$

Date of Using Room as Home Office

$

Repair and Maintenance

$

Fair Market Value of Home with Home Office

$

Utilities Except Water per Month

$

Cost of Home with Home Office

$

Rent Paid for Year

$

Improvement to Home Office

$

Other Specify:

$

Land Value on Property Tax Statement

$

Other Specify:

$

Building Value on Property Tax Statement

$

Other Specify:

$

Small Business Comments and Other Expenses:

1

1