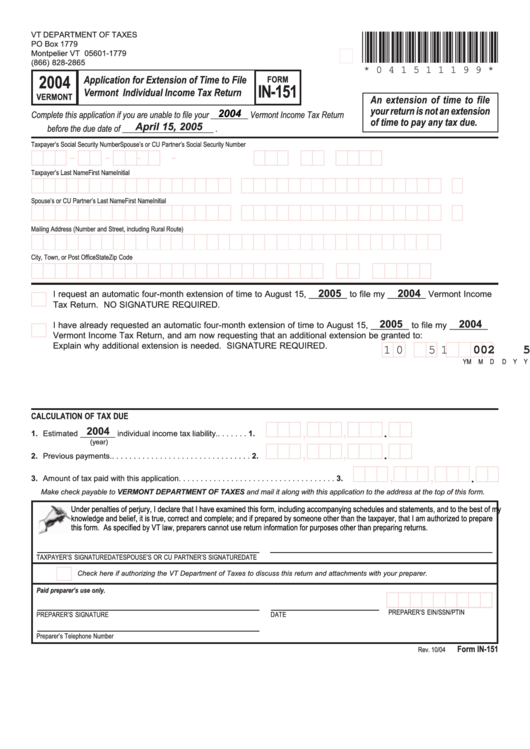

Form In-151 - Application For Extension Of Time To File Vermont Individual Income Tax Return - 2004

ADVERTISEMENT

VT DEPARTMENT OF TAXES

*041511199*

PO Box 1779

Montpelier VT 05601-1779

(866) 828-2865

* 0 4 1 5 1 1 1 9 9 *

2004

Application for Extension of Time to File

FORM

IN-151

Vermont Individual Income Tax Return

VERMONT

An extension of time to file

your return is not an extension

2004

Complete this application if you are unable to file your _________ Vermont Income Tax Return

of time to pay any tax due.

April 15, 2005

before the due date of ______________________ .

Taxpayer’s Social Security Number

Spouse’s or CU Partner’s Social Security Number

-

-

-

-

Taxpayer’s Last Name

First Name

Initial

Spouse’s or CU Partner’s Last Name

First Name

Initial

Mailing Address (Number and Street, including Rural Route)

City, Town, or Post Office

State

Zip Code

2005

2004

I request an automatic four-month extension of time to August 15, ________ to file my ________ Vermont Income

Tax Return. NO SIGNATURE REQUIRED.

2005

2004

I have already requested an automatic four-month extension of time to August 15, ________ to file my ________

Vermont Income Tax Return, and am now requesting that an additional extension be granted to:

Explain why additional extension is needed. SIGNATURE REQUIRED.

1 0

1

5

2

0

0

5

M M

D

D

Y

Y

Y Y

CALCULATION OF TAX DUE

,

,

.

2004

1. Estimated ________ individual income tax liability. . . . . . . . 1.

(year)

,

,

.

2. Previous payments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

,

,

.

3. Amount of tax paid with this application . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

Make check payable to VERMONT DEPARTMENT OF TAXES and mail it along with this application to the address at the top of this form.

Under penalties of perjury, I declare that I have examined this form, including accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct and complete; and if prepared by someone other than the taxpayer, that I am authorized to prepare

this form. As specified by VT law, preparers cannot use return information for purposes other than preparing returns.

TAXPAYER’S SIGNATURE

DATE

SPOUSE’S OR CU PARTNER’S SIGNATURE

DATE

Check here if authorizing the VT Department of Taxes to discuss this return and attachments with your preparer.

Paid preparer’s use only.

PREPARER’S EIN/SSN/PTIN

PREPARER’S SIGNATURE

DATE

Preparer’s Telephone Number

Form IN-151

Rev. 10/04

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1