Form Nc-Ac - Business Address Correction

ADVERTISEMENT

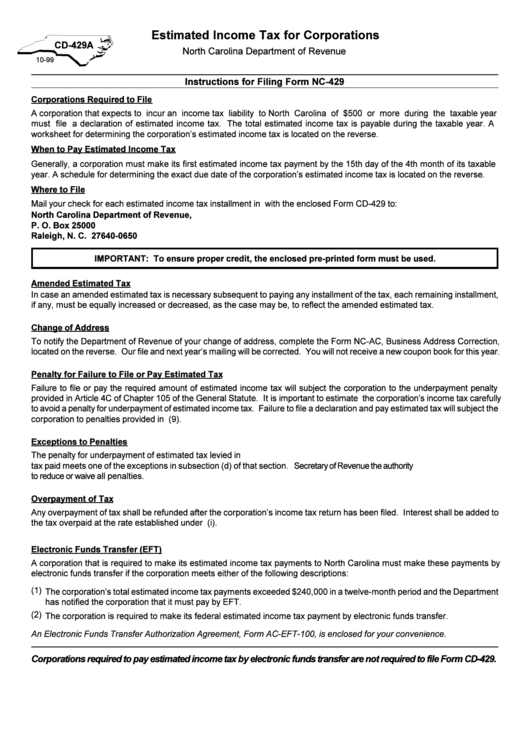

Estimated Income Tax for Corporations

CD-429A

North Carolina Department of Revenue

10-99

Instructions for Filing Form NC-429

Corporations Required to File

A corporation that expects to incur an income tax liability to North Carolina of $500 or more during the taxable year

must file a declaration of estimated income tax. The total estimated income tax is payable during the taxable year. A

worksheet for determining the corporation’s estimated income tax is located on the reverse.

When to Pay Estimated Income Tax

Generally, a corporation must make its first estimated income tax payment by the 15th day of the 4th month of its taxable

year. A schedule for determining the exact due date of the corporation’s estimated income tax is located on the reverse.

Where to File

Mail your check for each estimated income tax installment in U.S. currency only with the enclosed Form CD-429 to:

North Carolina Department of Revenue,

P. O. Box 25000

Raleigh, N. C. 27640-0650

IMPORTANT: To ensure proper credit, the enclosed pre-printed form must be used.

Amended Estimated Tax

In case an amended estimated tax is necessary subsequent to paying any installment of the tax, each remaining installment,

if any, must be equally increased or decreased, as the case may be, to reflect the amended estimated tax.

Change of Address

To notify the Department of Revenue of your change of address, complete the Form NC-AC, Business Address Correction,

located on the reverse. Our file and next year’s mailing will be corrected. You will not receive a new coupon book for this year.

Penalty for Failure to File or Pay Estimated Tax

Failure to file or pay the required amount of estimated income tax will subject the corporation to the underpayment penalty

provided in Article 4C of Chapter 105 of the General Statute. It is important to estimate the corporation’s income tax carefully

to avoid a penalty for underpayment of estimated income tax. Failure to file a declaration and pay estimated tax will subject the

corporation to penalties provided in G.S. 105-163.44 and G.S. 105-236(9).

Exceptions to Penalties

The penalty for underpayment of estimated tax levied in G.S. 105-163.41 will not be imposed if the total amount of estimated

tax paid meets one of the exceptions in subsection (d) of that section. G.S. 105-237 gives the Secretary of Revenue the authority

to reduce or waive all penalties.

Overpayment of Tax

Any overpayment of tax shall be refunded after the corporation’s income tax return has been filed. Interest shall be added to

the tax overpaid at the rate established under G.S. 105-241.1(i).

Electronic Funds Transfer (EFT)

A corporation that is required to make its estimated income tax payments to North Carolina must make these payments by

electronic funds transfer if the corporation meets either of the following descriptions:

(1)

The corporation’s total estimated income tax payments exceeded $240,000 in a twelve-month period and the Department

has notified the corporation that it must pay by EFT.

(2)

The corporation is required to make its federal estimated income tax payment by electronic funds transfer.

An Electronic Funds Transfer Authorization Agreement, Form AC-EFT-100, is enclosed for your convenience.

Corporations required to pay estimated income tax by electronic funds transfer are not required to file Form CD-429.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2