Form Boe-608 - Certificate Of Farming Use

ADVERTISEMENT

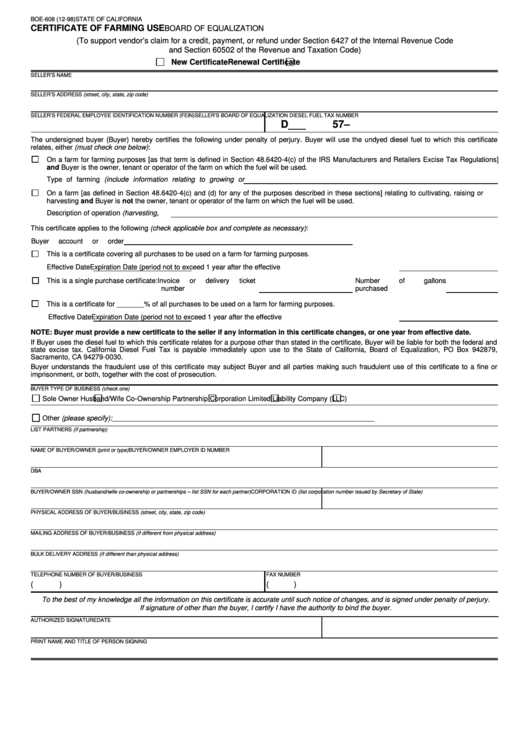

BOE-608 (12-98)

STATE OF CALIFORNIA

CERTIFICATE OF FARMING USE

BOARD OF EQUALIZATION

(To support vendor’s claim for a credit, payment, or refund under Section 6427 of the Internal Revenue Code

and Section 60502 of the Revenue and Taxation Code)

New Certificate

Renewal Certificate

SELLER’S NAME

SELLER’S ADDRESS (street, city, state, zip code)

SELLER’S FEDERAL EMPLOYEE IDENTIFICATION NUMBER (FEIN)

SELLER’S BOARD OF EQUALIZATION DIESEL FUEL TAX NUMBER

D___

57–

The undersigned buyer (Buyer) hereby certifies the following under penalty of perjury. Buyer will use the undyed diesel fuel to which this certificate

relates, either (must check one below):

On a farm for farming purposes [as that term is defined in Section 48.6420-4(c) of the IRS Manufacturers and Retailers Excise Tax Regulations]

and Buyer is the owner, tenant or operator of the farm on which the fuel will be used.

Type of farming (include information relating to growing or

On a farm [as defined in Section 48.6420-4(c) and (d) for any of the purposes described in these sections] relating to cultivating, raising or

harvesting and Buyer is not the owner, tenant or operator of the farm on which the fuel will be used.

Description of operation (harvesting,

This certificate applies to the following (check applicable box and complete as necessary):

Buyer

account

or

order

This is a certificate covering all purchases to be used on a farm for farming purposes.

Effective Date

Expiration Date (period not to exceed 1 year after the effective

This is a single purchase certificate: Invoice

or

delivery

ticket

Number

of

gallons

number

purchased

This is a certificate for _______% of all purchases to be used on a farm for farming purposes.

Effective Date

Expiration Date (period not to exceed 1 year after the effective

NOTE: Buyer must provide a new certificate to the seller if any information in this certificate changes, or one year from effective date.

If Buyer uses the diesel fuel to which this certificate relates for a purpose other than stated in the certificate, Buyer will be liable for both the federal and

state excise tax. California Diesel Fuel Tax is payable immediately upon use to the State of California, Board of Equalization, PO Box 942879,

Sacramento, CA 94279-0030.

Buyer understands the fraudulent use of this certificate may subject Buyer and all parties making such fraudulent use of this certificate to a fine or

imprisonment, or both, together with the cost of prosecution.

BUYER TYPE OF BUSINESS (check one)

Sole Owner

Husband/Wife Co-Ownership

Partnership

Corporation

Limited Liability Company (LLC)

Other (please specify):

LIST PARTNERS (if partnership)

NAME OF BUYER/OWNER (print or type)

BUYER/OWNER EMPLOYER ID NUMBER

DBA

BUYER/OWNER SSN (husband/wife co-ownership or partnerships – list SSN for each partner)

CORPORATION ID (list corporation number issued by Secretary of State)

PHYSICAL ADDRESS OF BUYER/BUSINESS (street, city, state, zip code)

MAILING ADDRESS OF BUYER/BUSINESS (if different from physical address)

BULK DELIVERY ADDRESS (if different than physical address)

TELEPHONE NUMBER OF BUYER/BUSINESS

FAX NUMBER

(

)

(

)

To the best of my knowledge all the information on this certificate is accurate until such notice of changes, and is signed under penalty of perjury.

If signature of other than the buyer, I certify I have the authority to bind the buyer.

AUTHORIZED SIGNATURE

DATE

PRINT NAME AND TITLE OF PERSON SIGNING

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1