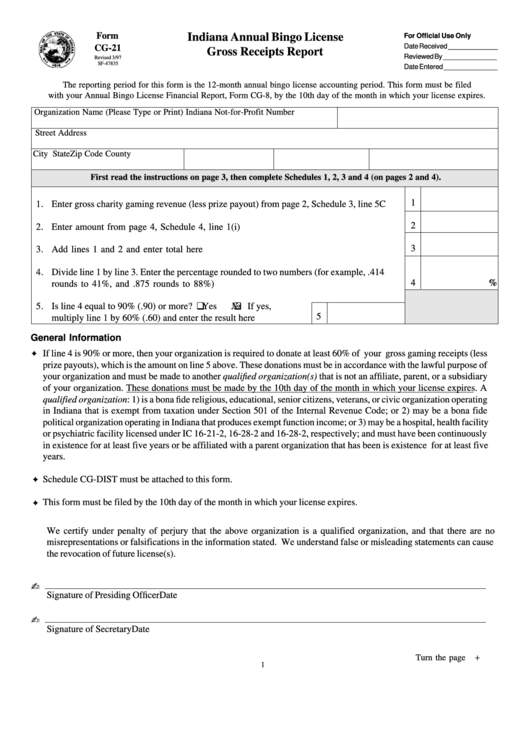

Form Cg-21 - Indiana Annual Bingo License Gross Receipts Report

ADVERTISEMENT

Form

Indiana Annual Bingo License

For Official Use Only

Date Received _____________

CG-21

Gross Receipts Report

Reviewed By ______________

Revised 3/97

SF-47835

Date Entered ______________

The reporting period for this form is the 12-month annual bingo license accounting period. This form must be filed

with your Annual Bingo License Financial Report, Form CG-8, by the 10th day of the month in which your license expires.

Organization Name (Please Type or Print)

Indiana Not-for-Profit Number

Street Address

City

State

Zip Code

County

First read the instructions on page 3, then complete Schedules 1, 2, 3 and 4 (on pages 2 and 4).

1

1.

Enter gross charity gaming revenue (less prize payout) from page 2, Schedule 3, line 5C ......

2

2.

Enter amount from page 4, Schedule 4, line 1(i) ...................................................................

3

3.

Add lines 1 and 2 and enter total here ..................................................................................

4.

Divide line 1 by line 3. Enter the percentage rounded to two numbers (for example, .414

4

%

rounds to 41%, and .875 rounds to 88%) .............................................................................

G

G

5.

Is line 4 equal to 90% (.90) or more?

Yes

No If yes,

5

multiply line 1 by 60% (.60) and enter the result here .....................

General Information

C

If line 4 is 90% or more, then your organization is required to donate at least 60% of your gross gaming receipts (less

prize payouts), which is the amount on line 5 above. These donations must be in accordance with the lawful purpose of

your organization and must be made to another qualified organization(s) that is not an affiliate, parent, or a subsidiary

of your organization. These donations must be made by the 10th day of the month in which your license expires. A

qualified organization: 1) is a bona fide religious, educational, senior citizens, veterans, or civic organization operating

in Indiana that is exempt from taxation under Section 501 of the Internal Revenue Code; or 2) may be a bona fide

political organization operating in Indiana that produces exempt function income; or 3) may be a hospital, health facility

or psychiatric facility licensed under IC 16-21-2, 16-28-2 and 16-28-2, respectively; and must have been continuously

in existence for at least five years or be affiliated with a parent organization that has been is existence for at least five

years.

C

Schedule CG-DIST must be attached to this form.

C

This form must be filed by the 10th day of the month in which your license expires.

We certify under penalty of perjury that the above organization is a qualified organization, and that there are no

misrepresentations or falsifications in the information stated. We understand false or misleading statements can cause

the revocation of future license(s).

N

Signature of Presiding Officer

Date

N

Signature of Secretary

Date

+

Turn the page

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3