Form E- 588 - Instructions - Refund Of County Tax

ADVERTISEMENT

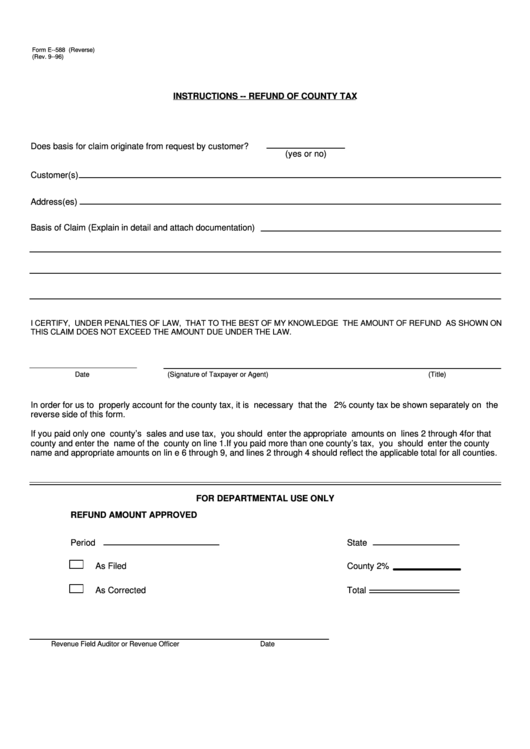

Form E--588 (Reverse)

(Rev. 9--96)

INSTRUCTIONS -- REFUND OF COUNTY TAX

Does basis for claim originate from request by customer?

(yes or no)

Customer(s)

Address(es)

Basis of Claim (Explain in detail and attach documentation)

I CERTIFY, UNDER PENALTIES OF LAW, THAT TO THE BEST OF MY KNOWLEDGE THE AMOUNT OF REFUND AS SHOWN ON

THIS CLAIM DOES NOT EXCEED THE AMOUNT DUE UNDER THE LAW.

Date

(Signature of Taxpayer or Agent)

(Title)

In order for us to properly account for the county tax, it is necessary that the 2% county tax be shown separately on the

reverse side of this form.

If you paid only one county’s sales and use tax, you should enter the appropriate amounts on lines 2 through 4 for that

county and enter the name of the county on line 1. If you paid more than one county’s tax, you should enter the county

name and appropriate amounts on line 6 through 9, and lines 2 through 4 should reflect the applicable total for all counties.

FOR DEPARTMENTAL USE ONLY

REFUND AMOUNT APPROVED

Period

State

As Filed

County 2%

As Corrected

Total

Revenue Field Auditor or Revenue Officer

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1