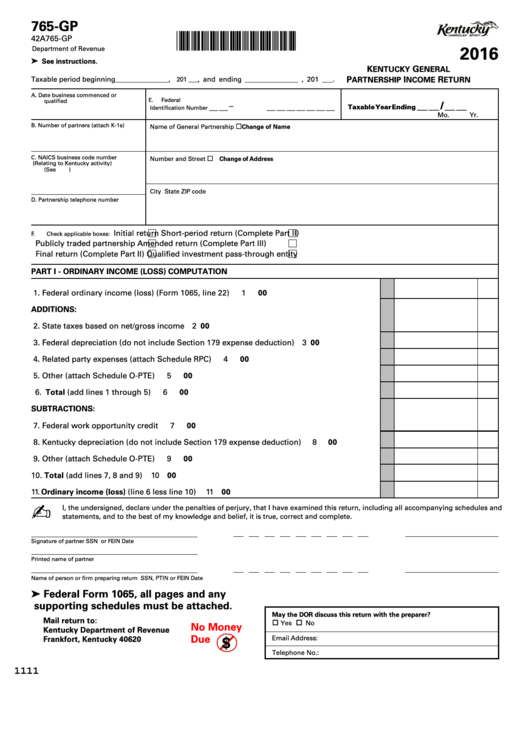

765-GP

*1600030034*

42A765-GP

2016

Department of Revenue

➤

See instructions.

K

G

ENTUCKY

ENERAL

P

I

R

Taxable period beginning _______________ ,

, and ending _______________ , 201 ___.

ARTNERSHIP

NCOME

ETURN

201 ___

A.

Date business commenced or

E.

Federal

qualified

__ __ / __ __

__ __ – __ __ __ __ __ __ __

Taxable Year Ending

Identification Number

Mo.

Yr.

B.

Number of partners (attach K-1s)

¨

Name of General Partnership

Change of Name

C.

NAICS business code number

¨

Number and Street

Change of Address

(Relating to Kentucky activity)

(See )

City

State

ZIP code

D.

Partnership telephone number

Initial return

Short-period return (Complete Part II)

F .

Check applicable boxes:

Publicly traded partnership

Amended return (Complete Part III)

Final return (Complete Part II)

Qualified investment pass-through entity

PART I - ORDINARY INCOME (LOSS) COMPUTATION

1. Federal ordinary income (loss) (Form 1065, line 22) ................................................................

1

00

ADDITIONS:

2. State taxes based on net/gross income .....................................................................................

2

00

3. Federal depreciation (do not include Section 179 expense deduction) ..................................

3

00

4. Related party expenses (attach Schedule RPC) .........................................................................

4

00

5. Other (attach Schedule O-PTE) ...................................................................................................

5

00

6. Total (add lines 1 through 5) .......................................................................................................

6

00

SUBTRACTIONS:

7. Federal work opportunity credit .................................................................................................

7

00

8. Kentucky depreciation (do not include Section 179 expense deduction) ...............................

8

00

9. Other (attach Schedule O-PTE) ...................................................................................................

9

00

10. Total (add lines 7, 8 and 9) ...........................................................................................................

10

00

11. Ordinary income (loss) (line 6 less line 10) ...............................................................................

11

00

✍

I, the undersigned, declare under the penalties of perjury, that I have examined this return, including all accompanying schedules and

statements, and to the best of my knowledge and belief, it is true, correct and complete.

Signature of partner

SSN or FEIN

Date

Printed name of partner

Name of person or firm preparing return

SSN, PTIN or FEIN

Date

➤ Federal Form 1065, all pages and any

supporting schedules must be attached.

May the DOR discuss this return with the preparer?

Mail return to:

Yes

No

No Money

Kentucky Department of Revenue

Due

$

Email Address:

Frankfort, Kentucky 40620

Telephone No.:

1111

1

1 2

2 3

3 4

4