Form Tc-20s - Computation Of Utah Net Taxable Income And Total Tax Due

ADVERTISEMENT

TC-20S A

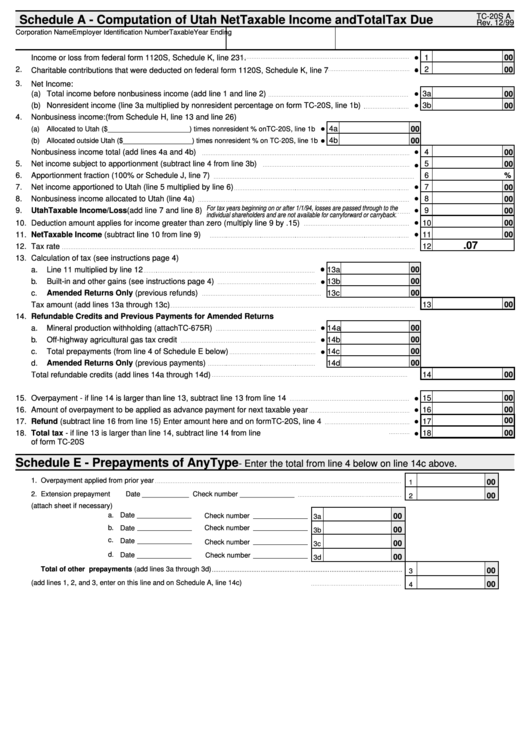

Schedule A - Computation of Utah Net Taxable Income and Total Tax Due

Rev. 12/99

Corporation Name

Taxable Year Ending

Employer Identification Number

1.

Income or loss from federal form 1120S, Schedule K, line 23

1

00

2.

2

00

Charitable contributions that were deducted on federal form 1120S, Schedule K, line 7

3.

Net Income:

(a)

Total income before nonbusiness income (add line 1 and line 2)

3a

00

(b)

Nonresident inco me (line 3a multiplied by nonresident percentage on form TC-20S, line 1b)

3b

00

4.

Nonbusiness income: (from Schedule H, line 13 and line 26)

4a

00

(a)

Allocated to Utah ($_____________________) times nonresident % on TC-20S, line 1b

4b

00

(b)

Allocated outside Utah ($__________________) times nonresident % on TC-20S, line 1b

Nonbusiness income total (add lines 4a and 4b)

4

00

5.

Net income subject to apportionment (subtract line 4 from line 3b)

5

00

6.

Apportionment fraction (100% or Schedule J, line 7)

6

%

7.

Net income apportioned to Utah (line 5 multiplied by line 6)

7

00

8.

Nonbusiness income allocated to Utah (line 4a)

8

00

For tax years beginning on or after 1/1/94, losses are passed through to the

9.

Utah Taxable Income/Loss (add line 7 and line 8)

9

00

individual shareholders and are not available for carryforward or carryback.

10.

Deduction amount applies for income greater than zero (multiply line 9 by .15)

10

00

11.

Net Taxable Income (subtract line 10 from line 9)

11

00

.07

12.

Tax rate

12

13.

Calculation of tax (see instructions page 4)

a.

Line 11 multiplied by line 12

13a

00

b.

Built-in and other gains (see instructions page 4)

13b

00

c.

Amended Returns Only (previous refunds)

13c

00

Tax amount (add lines 13a through 13c)

13

00

14.

Refundable Credits and Previous Payments for Amended Returns

a.

Mineral production withholding (attach TC-675R)

14a

00

b.

Off-highway agricultural gas tax credit

14b

00

c.

Total prepayments (from line 4 of Schedule E below)

14c

00

d.

Amended Returns Only (previous payments)

14d

00

Total refundable credits (add lines 14a through 14d)

14

00

15.

Overpayment - if line 14 is larger than line 13, subtract line 13 from line 14

15

00

16.

Amount of overpayment to be applied as advance payment for next taxable year

16

00

00

17.

Refund (subtract line 16 from line 15) Enter amount here and on form TC-20S, line 4

17

18.

Total tax - if line 13 is larger than line 14, subtract line 14 from line 13. Enter amount here and on line 5

18

00

of form TC-20S

Schedule E - Prepayments of Any Type

- Enter the total from line 4 below on line 14c above.

1.

Overpayment applied from prior year

00

1

2.

Extension prepayment

Date ____________ Check number ______________

00

2

3. Other prepayments (attach sheet if necessary)

a.

Date

Check number

00

3a

b.

Date

Check number

00

3b

c.

Date

Check number

00

3c

d.

Date

Check number

00

3d

Total of other prepayments (add lines 3a through 3d)

00

3

4. Total prepayments (add lines 1, 2, and 3, enter on this line and on Schedule A, line 14c)

00

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1